Choosing between the CFA (Chartered Financial Analyst) designation and an MBA (Master of Business Administration) can be a challenging decision for finance and business professionals.

While both are valuable credentials, the CFA Charter stands out for those who want to specialize in finance and investment.

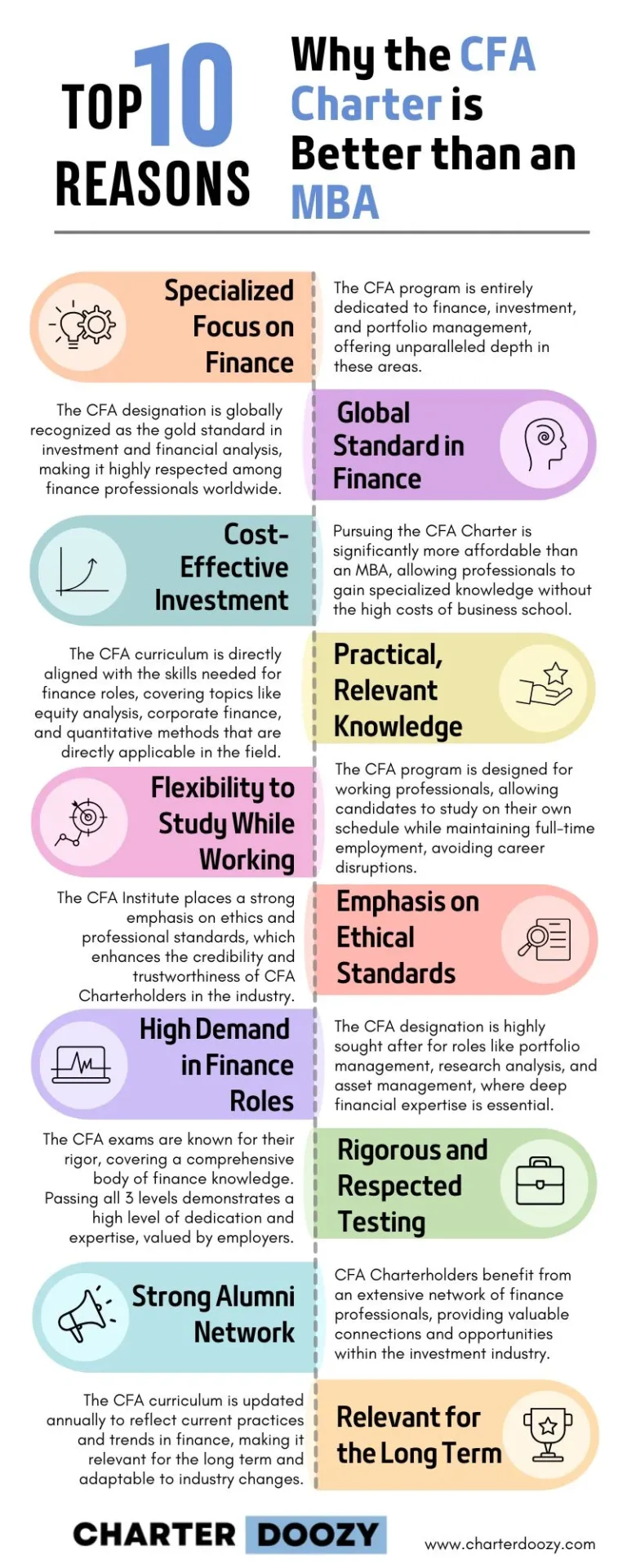

Here are the top 10 reasons why we believe the CFA Charter may be the better choice for your career goals.

Still unsure? Download our free 70 Essential Questions to Help You Decide: CFA or MBA?

#1 Specialized Focus on Finance

The CFA program is entirely dedicated to finance, investment, and portfolio management, offering a depth of knowledge that is difficult to match.

Unlike the MBA, which covers a broad range of business topics, the CFA is highly specialized, making it ideal for those committed to a finance-focused career.

If your goal is to become an expert in areas like equity analysis, fixed income, and asset management, the CFA is a more direct route to that expertise.

#2 Globally Recognized Standard in Finance

The CFA designation is known worldwide as the gold standard in investment management.

It’s recognized and respected across financial institutions, investment firms, and other finance-focused organizations around the globe.

For professionals aspiring to work in global finance hubs or multinational firms, the CFA designation is a passport that can open doors internationally.

#3 Cost-Effective Investment

An MBA can be a significant financial commitment, often requiring tens of thousands, or even hundreds of thousands, of dollars in tuition fees.

In contrast, the CFA is a more cost-effective path, with significantly lower fees and self-study options that allow candidates to continue working.

This affordability allows you to invest in a high-quality education without accumulating massive debt.

Doozy Digest

A newsletter for CFA candidates

Subscribe for:

✔ Insightful tips

✔ Expert advice

✔ Career motivation

✔ Exam inspiration

Stay updated and subscribe today!

#4 Practical, Industry-Relevant Knowledge

The CFA curriculum is directly aligned with the skills required in finance roles.

Covering topics like corporate finance, equity valuation, derivatives, and quantitative methods, the CFA prepares you for the real-world challenges of financial analysis and portfolio management.

If your goal is to apply your knowledge directly to investment and finance roles, the CFA’s practical curriculum provides exactly what you need.

#5 Flexibility to Study While Working

One of the biggest advantages of the CFA program is its flexibility.

Designed with working professionals in mind, it allows you to study at your own pace and schedule, meaning you can continue building your career while preparing for the exams.

This flexibility is particularly beneficial for those who cannot afford to take a break from work to pursue an MBA full-time.

#6 Emphasis on Ethical Standards

The CFA Institute places a strong emphasis on ethics and professional standards.

The CFA program instills a high level of integrity, which is crucial in finance where trust and ethical conduct are paramount.

For employers, this focus on ethics can make CFA Charterholders stand out as trustworthy professionals who are committed to upholding the highest standards.

#7 High Demand in Finance Roles

The CFA designation is highly sought after in various finance roles, including portfolio management, research analysis, and asset management.

These positions demand specialized financial knowledge and analytical skills, which the CFA program provides.

For those who want to excel in finance-specific roles, the CFA often carries more weight and relevance than an MBA.

#8 Rigorous and Respected Testing Process

The CFA exams are known for their rigor and difficulty, covering a comprehensive body of finance knowledge over three levels.

Passing all three levels of the CFA exams demonstrates a high level of dedication, discipline, and expertise, qualities that are valued by employers.

This rigorous testing process makes the CFA designation a mark of excellence in the finance industry.

#9 Strong Alumni Network in Finance

While the MBA also offers networking opportunities, the CFA Charter comes with a dedicated network of finance professionals.

The CFA Institute has a vast, global network of charterholders and members, providing valuable connections within the investment and finance sectors.

This network can be a great asset for career growth, mentorship, and accessing job opportunities.

#10 Relevant for the Long Term in Finance

The CFA curriculum is updated annually to reflect current industry practices, trends, and regulations, ensuring that charterholders stay relevant in the ever-evolving field of finance.

This commitment to staying current makes the CFA program a long-term investment that adapts to industry changes, giving charterholders the skills needed to thrive throughout their careers.

Both the CFA Charter and an MBA offer valuable benefits.

However, the CFA’s specialized focus, industry relevance, and cost-effectiveness make it an excellent (the better) choice for those who are serious about a career in finance.

With a strong emphasis on ethical standards, global recognition, and a practical curriculum, the CFA designation prepares you for the demands of the financial industry while allowing you to study at your own pace.

If you’re considering a career in finance and investment management, the CFA Charter could be the key to unlocking your potential and advancing in the finance world.

Whether you’re already in the industry or looking to pivot, the CFA designation equips you with the specialized skills, knowledge, and network to excel.

Still unsure? Download our free 70 Essential Questions to Help You Decide: CFA or MBA?