Are you standing at a career crossroads, wondering if an MBA or a CFA designation is the right step forward?

This guide will help you navigate this significant decision by diving into every aspect of both paths.

Let’s explore what each designation can offer you, from career development to cost, networking, and the skills that set each credential apart.

Exploring the MBA’s Role in Broad Business Development

Broad Business and Leadership Skills

An MBA program equips students with a wide-ranging skill set, spanning finance, marketing, management, operations, and organizational behavior. This holistic curriculum is crafted to create well-rounded business professionals who understand how different departments and functions interact to drive an organization’s success.

Holistic Curriculum: The MBA is renowned for its breadth. Courses in finance, marketing, and operations ensure students gain insights into the core functions of a business. This comprehensive approach fosters a well-rounded understanding, enabling MBA graduates to see the bigger picture in business decision-making and strategy.

Leadership Development: Beyond technical knowledge, MBA programs place a strong emphasis on cultivating leadership abilities. Courses in team management, emotional intelligence, and decision-making aim to prepare students for the challenges of leading teams and managing complex business operations. Many MBA programs also offer electives in negotiation, corporate strategy, and entrepreneurship, allowing students to refine specific skills that align with their career ambitions.

Strategic Thinking

The strategic mindset developed through an MBA is invaluable, especially for those aiming for executive roles or positions requiring long-term vision. MBA students are trained to analyze complex business challenges, create actionable strategies, and navigate an increasingly globalized market.

High-Level Problem Solving: MBA programs encourage students to think critically and approach problems from multiple angles. They are taught to evaluate risks and create high-level solutions that align with the organization’s goals.

Case Studies: A hallmark of top MBA programs, the case study method allows students to engage with real-world business scenarios. By analyzing case studies, students sharpen their strategic thinking, exploring how others in similar positions have addressed issues and adapted their strategies over time. This hands-on approach helps develop practical problem-solving skills that are immediately applicable in the workplace.

Networking Opportunities

One of the defining features of an MBA program is the extensive network of alumni, faculty, and industry connections it provides. For many MBA graduates, this network is just as valuable as the knowledge gained in the classroom.

Alumni Networks: Alumni connections are a priceless asset of an MBA, with top programs boasting vast global networks. These networks offer mentorship, job opportunities, and guidance on navigating various industries, often proving essential for those aiming to switch careers or move up the corporate ladder.

Industry Connections: MBA programs frequently host networking events, career fairs, and speaker series featuring leaders from diverse industries. These events offer students an invaluable chance to interact with potential employers, peers, and industry experts, broadening their professional horizons and creating pathways for future career advancements.

So, the MBA’s combination of broad business skills, leadership training, strategic insight, and networking makes it a versatile credential.

If you aspire to lead teams, transition into executive roles, or move across different industries, the MBA may be the ideal choice.

Outlining the CFA’s Technical Focus on Investment Analysis, Financial Modeling, and Ethics

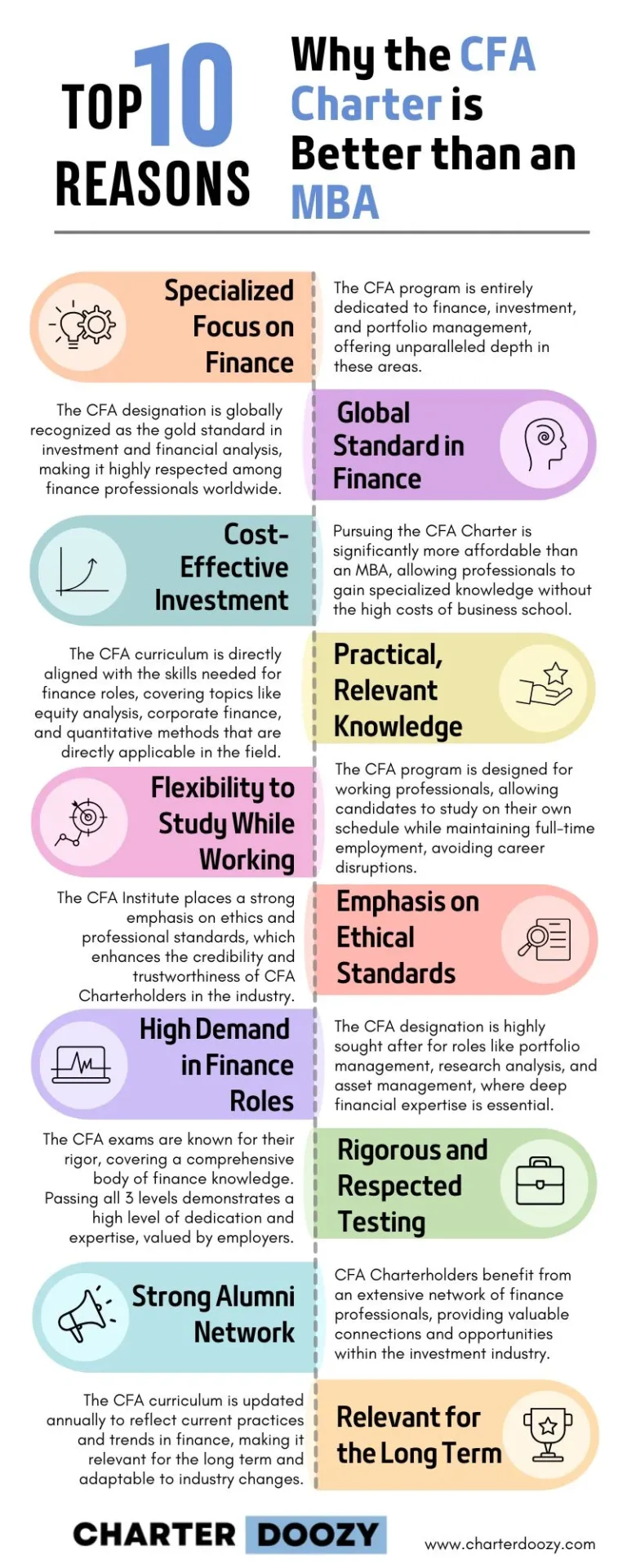

The CFA (Chartered Financial Analyst) designation is known for its rigorous focus on investment analysis, financial modeling, and ethical standards.

Unlike the MBA’s broad curriculum, the CFA Program is laser-focused on finance, designed for those who aim to specialize in areas like investment management, portfolio analysis, and financial advisory roles.

For finance professionals who seek to master technical skills and establish credibility within the investment sector, the CFA designation offers unparalleled depth and focus.

Investment Analysis and Financial Modeling

Investment analysis and financial modeling form the backbone of the CFA curriculum, equipping candidates with the tools to make data-driven investment decisions and manage assets across various finance roles.

In-Depth Finance Knowledge: The CFA Program covers a comprehensive array of topics central to finance, including equity and fixed-income analysis, portfolio management, derivatives, and quantitative methods. Each level of the program delves deeper into these areas, progressively building candidates’ expertise. This curriculum is specifically designed to create proficient analysts and finance professionals who can analyze assets, evaluate investment opportunities, and develop sound financial strategies.

Practical Application: Beyond theoretical knowledge, the CFA emphasizes practical application. Candidates learn to apply financial models, valuation techniques, and quantitative methods, essential skills for asset managers, analysts, and financial advisors. By the time they complete the program, CFA charterholders have a solid foundation in creating and interpreting complex financial models, a skill highly valued in sectors like investment banking, equity research, and risk management.

Ethical Standards

A commitment to ethics is woven into the fabric of the CFA Program, distinguishing it from other finance credentials. The CFA Institute places a strong emphasis on ethics as a cornerstone of professional conduct, instilling principles that resonate with clients and employers alike.

Foundation of Ethics: Ethics is not just an add-on in the CFA curriculum; it’s a critical component of each exam level. The CFA Code of Ethics and Standards of Professional Conduct is a dedicated topic area on every exam, reinforcing the importance of integrity, transparency, and accountability. Candidates are trained to uphold ethical principles even in challenging situations, making ethics a practiced, internalized standard rather than just theoretical knowledge.

Integrity and Trust: In a field where client trust is paramount, CFA charterholders are seen as professionals who prioritize ethical conduct. Employers value this ethical foundation, especially in roles that involve managing client wealth or making significant financial decisions. The CFA Program’s emphasis on ethics also supports long-term credibility, as clients and firms increasingly prioritize ethical standards when hiring finance professionals.

Doozy Digest

A newsletter for CFA candidates

Subscribe for:

✔ Insightful tips

✔ Expert advice

✔ Career motivation

✔ Exam inspiration

Stay updated and subscribe today!

The CFA Program’s technical depth distinguishes it from generalist programs like the MBA. Its structured, sequential approach enables candidates to develop expertise in specific areas essential to asset management and finance.

Specialized Content: The CFA curriculum is highly specialized, covering topics like security valuation, portfolio optimization, and capital markets in great depth. This focused knowledge is essential for professionals in investment management, where deep technical understanding can directly impact portfolio performance and client outcomes. As a result, CFA Charterholders are particularly valued in roles where technical finance skills and precision are non-negotiable.

Career Alignment: The program’s structure aligns well with finance and asset management roles. Each exam level builds upon the last, advancing from foundational knowledge to complex, applied finance topics. This gradual development creates a path well-suited to career progression in finance-specific roles, particularly in asset management, portfolio analysis, and corporate finance. For professionals who are committed to a finance-focused career, the CFA designation is an asset that signals both expertise and dedication.

The CFA designation is an ideal choice for professionals who seek specialized skills in investment analysis, financial modeling, and ethics.

With its rigorous focus and ethical foundation, the CFA Program sets a high standard for financial expertise and professional conduct, making CFA Charterholders respected professionals in the finance industry.

Ideal Professional Profiles for Each Designation

Choosing between an MBA and a CFA designation is a pivotal decision, one that largely depends on your professional aspirations and the skills you wish to develop.

Both paths offer unique advantages, but they cater to distinct career profiles and ambitions.

Here, we’ll explore who might benefit most from each qualification to help you determine which path aligns with your goals.

Who Should Consider an MBA

The MBA program is tailored for professionals seeking a broad, well-rounded business education that prepares them for leadership roles and cross-functional business management.

With an emphasis on strategic thinking, leadership, and networking, the MBA is ideal for those who envision themselves in dynamic, generalist roles where versatility and a big-picture perspective are essential.

Aspiring Leaders: For individuals aiming to step into general management, corporate leadership, or business development roles, an MBA is invaluable. The program equips aspiring leaders with the knowledge and skills to make high-stakes decisions, manage teams, and oversee multiple aspects of an organization. MBAs often find themselves well-prepared for positions such as project managers, directors, or executives, where they can leverage their broad business expertise to drive organizational success.

Entrepreneurs: Entrepreneurs and those interested in launching or scaling a business find that the MBA provides a structured approach to strategic planning, operations, and team management. Many MBA programs offer courses in entrepreneurship, venture capital, and innovation, helping students gain practical insights into building a business from the ground up. Additionally, access to networks, mentors, and funding resources is a major benefit, enabling MBA entrepreneurs to connect with potential investors, advisors, and collaborators essential for business growth.

Who Should Consider a CFA

The CFA designation is a rigorous, finance-focused credential that appeals to professionals dedicated to finance-specific roles, especially in areas such as investment management, equity research, and portfolio analysis. The CFA Program emphasizes technical proficiency, ethical standards, and quantitative analysis, making it an ideal path for those who want to become experts in the field of finance.

Finance Specialists: For professionals who want to deepen their expertise in investment management, equity research, financial analysis, or similar fields, the CFA designation is unmatched. It offers a specialized, technical focus on finance that enables candidates to master topics like asset valuation, portfolio management, and financial reporting. The CFA credential is particularly suited for analysts, portfolio managers, and finance professionals who work with complex financial data and make high-stakes investment decisions.

Ethically Driven Professionals: The CFA designation appeals to individuals who prioritize ethical standards in finance roles. A core component of the CFA curriculum is the CFA Code of Ethics and Standards of Professional Conduct, which instills a commitment to integrity and fiduciary responsibility. This focus on ethics is essential for professionals managing client wealth, analyzing investments, and providing financial advisory services, where trust and accountability are critical. For those who are committed to upholding high ethical standards within finance, the CFA designation reinforces their credibility and builds client trust.

So, the MBA is designed for those who aspire to broad business leadership, thrive in management roles, or aim to build and grow companies.

In contrast, the CFA is an intensive, technical credential ideal for those who seek specialized finance knowledge, technical expertise, and a commitment to ethical standards in investment-related roles.

Understanding these professional profiles can help guide you toward the qualification that best aligns with your career goals and values.

Career Paths Post-MBA

An MBA opens doors to a variety of rewarding career paths, particularly in fields that value strategic thinking, leadership, and a broad understanding of business functions.

MBA graduates find themselves well-prepared for roles that require problem-solving across multiple dimensions of business, often in fast-paced environments where versatility and adaptability are crucial.

Here, we explore three prominent paths for MBA holders: management consulting, corporate leadership, and entrepreneurship.

Management Consulting

The management consulting field offers MBA graduates the opportunity to work on high-impact projects across diverse industries, from finance to healthcare to technology. Management consultants are problem-solvers who provide strategic guidance to clients, addressing critical issues that range from operational inefficiencies to market expansion strategies. This field is known for its fast-paced environment, intellectual challenges, and the potential for rapid career growth.

Problem Solving: In consulting, MBAs are expected to tackle complex, real-world business issues for a variety of clients. Consultants analyze data, identify problems, and craft tailored solutions to meet client needs. The problem-solving nature of consulting allows MBA graduates to apply strategic thinking and analytical skills in a dynamic setting, often yielding immediate, tangible results for clients.

Growth Opportunities: Consulting firms typically have well-defined growth paths, allowing consultants to progress from entry-level associates to senior consultants, managers, and eventually partners. Many MBA graduates also use consulting as a springboard to transition into leadership roles within client organizations, capitalizing on their industry exposure and network to move into executive positions.

Corporate Leadership

For those aiming to take on significant responsibilities within a single organization, a career in corporate leadership is an ideal fit. Corporate leadership roles allow MBA graduates to navigate complex challenges, lead cross-functional teams, and drive innovation across departments. This path is especially appealing to those who want to create a long-term impact within one organization, guiding its strategic direction and growth.

Strategic Impact: Corporate leaders are tasked with steering their organizations through complex business challenges, including market competition, technological changes, and organizational restructuring. MBAs in these roles often leverage their strategic insight to make high-level decisions that shape the future of the business. Their responsibilities may include identifying new opportunities, optimizing operations, and overseeing financial performance.

Career Progression: MBA graduates typically start in mid-level management positions, such as product managers, operations managers, or finance managers, before progressing to senior leadership roles. With experience and a track record of success, they may advance to the C-suite (CEO, CFO, COO) or other executive roles, where they oversee entire divisions or the company as a whole. These roles are challenging but rewarding, as leaders have the potential to make a significant impact on organizational success.

Entrepreneurship

For MBA graduates drawn to the idea of building something from the ground up, entrepreneurship is an attractive and fulfilling career path. The skills developed in an MBA program—strategic planning, finance, marketing, and leadership—are invaluable for those who want to start, scale, or manage their own businesses. Additionally, MBA programs provide access to resources, networks, and mentorship that can be critical to an entrepreneur’s journey.

Business Creation: Many MBAs leverage their education to launch new ventures or grow existing ones. Courses in entrepreneurship, finance, and operations provide the foundational knowledge needed to develop and implement business plans, secure funding, and manage day-to-day operations. Whether founding a tech startup or expanding a family business, MBA graduates often find that their education directly supports their entrepreneurial goals.

Networking: MBA programs are renowned for the networking opportunities they offer, which are particularly valuable in entrepreneurship. Access to incubators, venture capital networks, and business competitions enables MBA graduates to connect with potential investors, advisors, and collaborators who can play pivotal roles in their ventures. The MBA network provides a strong support system, helping entrepreneurs navigate the challenges of launching and scaling a business.

The MBA opens doors to career paths that require strong leadership, strategic thinking, and problem-solving abilities.

Whether consulting for top-tier firms, leading in the corporate world, or building a business from scratch, MBA graduates are equipped with the skills, knowledge, and connections to make a meaningful impact in their chosen fields.

Each path offers unique challenges and rewards, allowing MBA holders to carve out careers that align with their professional ambitions and personal aspirations.

Career Trajectories for CFA Charterholders

CFA Charterholders are particularly suited for career paths that emphasize advanced financial analysis, investment strategies, and ethical standards.

Known for their rigorous training in quantitative methods and ethics, CFAs bring value to organizations through their deep understanding of financial markets and investment tools.

Here, we explore three prominent career trajectories for CFA Charterholders: investment banking, portfolio management, and equity research.

Investment Banking

In the high-stakes world of investment banking, CFA Charterholders play crucial roles in helping corporations, governments, and other entities secure financing and make strategic financial decisions. While MBAs are often drawn to investment banking for the strategic business angle, CFA Charterholders bring a technical edge, with deep expertise in financial valuation and capital markets.

Financial Strategy: CFA Charterholders assist clients with complex financial transactions, including raising capital through debt and equity offerings and advising on mergers and acquisitions (M&A). Their technical skills in valuation, quantitative analysis, and financial modeling enable them to provide insights into optimal financial strategies, deal structuring, and risk assessment.

Career Advancement: Investment banking offers a structured career path, with professionals typically beginning as analysts before advancing to associate, vice president, and ultimately managing director roles. CFA Charterholders are valued for their analytical rigor, which often accelerates their career progression. Many eventually transition into leadership positions or move into private equity or venture capital, where their skills in assessing investment potential are highly valuable.

Portfolio Management

Portfolio management is a natural career fit for CFA Charterholders, who specialize in asset allocation, risk management, and return optimization. As stewards of client assets, portfolio managers make critical decisions to achieve investment objectives, balancing growth opportunities with risk management strategies. This path is particularly attractive to CFAs due to its emphasis on financial modeling and strategic decision-making.

Asset Allocation: In portfolio management, CFA Charterholders analyze market conditions, economic trends, and client goals to make informed asset allocation decisions. They are responsible for managing portfolios that may include a mix of equities, fixed-income securities, derivatives, and alternative investments. Their goal is to optimize returns while adhering to clients’ risk tolerance and investment timelines.

Leadership Roles: Portfolio managers often start as analysts or junior portfolio managers, working under the guidance of more senior professionals. Over time, they may advance to senior portfolio manager roles, overseeing larger portfolios or managing multiple teams. Experienced portfolio managers can also progress to chief investment officer (CIO) positions, where they set the overall investment strategy for the firm and make high-level allocation decisions.

Equity Research

Equity research is a compelling field for CFA Charterholders who enjoy in-depth analysis of companies, sectors, and market trends. Equity research analysts provide valuable insights that inform investment decisions, advising clients on which stocks to buy, hold, or sell. This role suits CFAs due to its reliance on financial modeling, valuation, and market analysis.

Market Analysis: In equity research, CFA Charterholders conduct thorough research on publicly traded companies, assessing their financial health, industry positioning, and growth potential. They analyze financial statements, interview management teams, and monitor industry trends to produce recommendations for investors. Their analyses are critical for clients looking to make informed stock market investments.

Career Growth: Equity research offers clear advancement opportunities, with professionals progressing from junior analysts to senior analysts, and eventually, to heads of research departments. Many CFA Charterholders in equity research choose to move to the buy-side, working for asset management firms, hedge funds, or private equity firms where they apply their analytical skills to directly manage investment portfolios.

I personally know this to be true.

CFA Charterholders have rewarding career options that leverage their expertise in investment analysis, financial modeling, and ethical standards.

Whether advising on mergers and acquisitions in investment banking, managing client portfolios for optimal returns, or conducting in-depth market analysis in equity research, CFAs are equipped with the skills and insights needed to make a substantial impact in their chosen fields.

Each career path offers unique challenges and growth potential, allowing CFAs to apply their rigorous training to roles that align with their professional goals and commitment to ethical finance.

Supporting Career Switches and Advancements

For professionals considering significant career shifts or seeking advancement within their current field, the MBA and CFA designations offer tailored benefits.

While an MBA program provides the broad-based skills and network necessary for cross-industry mobility, the CFA designation delivers specialized expertise that propels careers within finance.

MBA for Career Switching and Broader Business Roles

The MBA’s generalist approach and focus on leadership, strategy, and management make it an excellent choice for individuals aiming to transition into new industries or broaden their roles within business.

An MBA equips candidates with versatile skills, fostering adaptability and an expansive understanding of business operations.

Versatility: With courses spanning marketing, operations, finance, and management, the MBA delivers a comprehensive business education that enables candidates to pivot between functions or industries. This versatility is especially advantageous for those looking to transition from non-business backgrounds into corporate, consulting, or startup roles where business acumen is essential.

Resources: Most MBA programs offer robust career support, including career counseling, internships, and connections to recruiters. Business schools often have expansive alumni networks and dedicated career services that specialize in assisting career changers. These resources offer guidance and access to job opportunities, making it easier to secure roles that align with new professional goals.

CFA for Finance-Specific Career Advancement

For those committed to advancing within finance, the CFA designation is unparalleled in terms of depth and relevance.

The CFA’s highly specialized curriculum sharpens expertise in investment management, valuation, and ethical finance practices, providing a focused pathway for career growth in specific finance roles.

Specialization: Unlike the MBA’s broad curriculum, the CFA Program dives deeply into finance-specific topics, such as asset valuation, portfolio management, and risk analysis. This technical depth is invaluable for professionals aiming to elevate their standing within the finance industry, whether they seek to move up in asset management, transition into a hedge fund, or specialize further in quantitative finance.

Focused Transition: While not designed for industry-switching, the CFA is ideal for transitioning within finance roles—such as moving from a back-office role to front-office positions like portfolio management or investment analysis. By developing highly sought-after skills in financial modeling and ethics, the CFA designation enables a smooth transition into specialized finance roles that demand technical proficiency and ethical rigor.

Both the MBA and CFA pathways support career growth and transitions but cater to different professional needs.

The MBA empowers broad career shifts and opens doors across industries, supported by its versatile curriculum and extensive resources.

In contrast, the CFA offers a focused route to career advancement within finance, providing in-depth knowledge and ethical training tailored for finance professionals aiming to deepen their specialization and reach new heights in the industry.

Explore our top 10 reasons why the CFA Charter is a better choice than an MBA for finance professionals, from cost-effectiveness to industry relevance.

Comparative Analysis of Costs, Time, and Financial Outcomes

The choice between pursuing an MBA or a CFA designation often hinges on a careful evaluation of financial costs, time commitment, and potential salary increases.

Here’s a breakdown of these considerations to help gauge the investment and return for each path.

Financial Investment

Both the MBA and CFA represent significant financial investments, though with stark differences in cost structures due to the nature of the programs.

MBA Cost: Tuition fees for an MBA vary widely based on the institution, ranging from $60,000 at lower-cost universities to over $200,000 at top-tier business schools. Additional expenses, such as books, living costs, and potential income loss during full-time study, add to the overall cost. For many, this investment is justified by the access to resources, networking opportunities, and post-MBA salary increases.

CFA Cost: The CFA Program is far more affordable, with total exam fees between $2,400 and $4,500, excluding study materials, which are typically around $500 per level. Unlike the MBA, most CFA candidates continue working while studying, minimizing opportunity costs and making the CFA a more budget-friendly option for finance-specific career growth.

See our financial cost-benefit analysis of the MBA v CFA.

The results were surprising!

Time Commitment

Time requirements for the MBA and CFA vary, impacting not only study schedules but also the time each candidate can expect before reaping the rewards of their investment.

MBA Duration: Full-time MBA programs typically last two years, though accelerated one-year programs exist. Part-time and executive MBA options, designed for working professionals, may take anywhere from two to five years to complete. Full-time MBAs generally require candidates to take a break from their careers, whereas part-time options allow continued employment.

CFA Duration: Candidates usually complete the CFA Program in 3-4 years, dedicating an average of 300 hours per level annually. The time needed can extend if candidates take longer to pass each level. However, unlike the MBA, the CFA designation is often pursued alongside full-time work, allowing for steady career progression during the qualification process.

Estimated Financial Outcomes

The financial returns from an MBA or CFA vary based on individual career goals, industry standards, and experience levels, with starting salaries and salary growth potential differing between the two paths.

MBA Salary Boost: MBA graduates from reputable schools see starting salaries ranging from $120,000 to $160,000, with additional bonuses or stock options, depending on the role and industry. This boost is often accompanied by broader career opportunities in management and executive roles, with significant long-term earning potential as alumni move into senior positions.

CFA Salary Boost: CFA charterholders, especially in investment management and research roles, enjoy starting salaries typically between $70,000 and $100,000. While the initial salary increase might be lower than that of an MBA, charterholders can attain competitive compensation as they progress within the finance industry, especially in portfolio management, asset management, and investment banking roles.

In essence, the MBA represents a broader investment with significant upfront costs but delivers high earning potential across various industries, particularly in leadership roles.

The CFA, more affordable and specialized, offers substantial financial returns within finance-specific careers, making it an appealing choice for those committed to finance without needing a broader management background.

Both options present different financial and career benefits, suiting distinct career aspirations and financial considerations.

Networking Opportunities

Networking opportunities are a defining feature for both MBA programs and the CFA designation, offering pathways to career mobility, industry connections, and professional growth.

MBA Alumni Networks

MBA alumni networks are one of the most valuable assets for graduates, providing long-term career support and access to influential professionals worldwide.

Global Reach: Top business schools boast extensive global networks, enabling graduates to connect with alumni in various industries and regions. These networks offer valuable resources for both personal and professional connections, allowing graduates to leverage contacts across continents.

Career Mobility: Alumni networks are instrumental in aiding career transitions and advancing to executive positions. Through mentorship, referrals, and shared opportunities, MBA graduates benefit from an expansive support system, making it easier to transition into new roles or industries, particularly in management and consulting.

CFA Institute’s Local Societies

The CFA Institute’s local societies provide networking opportunities that are distinctly industry-focused, aligning with the needs of finance professionals and fostering growth within the finance community.

Industry Focused: Local CFA societies connect members within the finance industry, creating a concentrated network of investment professionals, analysts, and portfolio managers. These connections allow charterholders to engage with peers and industry leaders, fostering relationships that enhance career growth within specialized finance roles.

Continued Learning: CFA societies offer ongoing professional development through finance-focused events, workshops, and seminars. Charterholders can attend local and global conferences, panel discussions, and career-oriented sessions that ensure they stay current on industry trends, regulatory changes, and new financial practices while expanding their professional network.

In summary, MBA programs provide a versatile network ideal for career changes and leadership roles, while CFA societies offer a specialized network for finance professionals looking to deepen their expertise and connect with like-minded individuals in the industry.

Both pathways provide access to invaluable networks that support long-term career success and development.

Curriculum and Teaching Methods

The curriculum structure and teaching methods of the MBA and CFA programs cater to distinct educational and professional objectives, each offering a unique approach to learning.

MBA Curriculum Flexibility

The MBA curriculum is renowned for its adaptability, enabling students to shape their learning experience to align with individual career aspirations.

Electives and Specializations: MBA programs typically offer a broad selection of electives and concentrations, allowing students to tailor their education to specific interests, such as marketing, finance, entrepreneurship, or international business. This flexibility supports the development of specialized skills within a broad business foundation.

Experiential Learning: MBA programs emphasize hands-on learning through case studies, group projects, and simulations, providing students with the opportunity to tackle real-world business problems. These experiences enhance critical thinking, decision-making, and teamwork skills, preparing graduates for practical challenges in diverse industries.

CFA Program Structure

The CFA Program, in contrast, offers a standardized curriculum centered on deep financial knowledge, making it highly focused and rigorous.

Standardized Curriculum: The CFA Program focuses on core finance topics without the flexibility of electives. Subjects include ethics, quantitative methods, economics, financial reporting, and portfolio management. This standardized approach ensures that all candidates master essential finance concepts, making the CFA designation a mark of consistency in financial knowledge.

Self-Study Format: The CFA Program is structured as a self-study curriculum, demanding a high degree of discipline, self-motivation, and time management. Candidates progress through the three exam levels at their own pace, allowing them to balance study with full-time work but also requiring substantial commitment and perseverance.

In summary, the MBA curriculum offers flexibility and hands-on learning experiences, ideal for those seeking a broad and adaptable business education, while the CFA Program’s structured, self-study approach suits those committed to gaining in-depth expertise in finance with a standardized, globally recognized curriculum.

Skills Developed

The MBA and CFA programs emphasize different skill sets that cater to distinct aspects of business and finance.

Each offers unique capabilities tailored to specific career goals, with the MBA focusing on broader, people-oriented skills and the CFA delivering finance-specific technical expertise.

Soft Skills from an MBA

An MBA program provides extensive opportunities to build interpersonal and management skills that are essential for leadership roles.

Leadership: Through team projects and leadership roles within the program, MBA candidates develop the skills to manage teams, inspire others, and foster a strategic vision. This prepares them to lead initiatives and drive change in corporate or entrepreneurial settings.

Communication: MBA programs emphasize effective communication, from public speaking and presentations to writing and interpersonal interactions. These skills help graduates articulate ideas clearly and influence stakeholders, which is crucial for roles in management, consulting, and client-facing functions.

Negotiation: Negotiation skills are honed through case studies, mock negotiations, and conflict resolution exercises, equipping MBA graduates to navigate complex deals, resolve disputes, and create mutually beneficial agreements.

Technical Skills from the CFA

The CFA Program, with its specialized finance curriculum, provides deep technical expertise, preparing candidates for demanding analytical roles in the finance industry.

Financial Expertise: CFA candidates develop an advanced understanding of investment analysis, corporate finance, and portfolio management. This expertise is particularly valuable in roles focused on asset management, equity research, and financial advisory.

Data Analysis: The CFA curriculum emphasizes quantitative methods and financial modeling, training candidates to interpret complex data sets and apply statistical techniques. These skills are essential for roles that require rigorous data analysis, such as investment banking and risk assessment.

Problem-Solving: CFA candidates learn to approach financial issues with strong problem-solving abilities, utilizing valuation techniques and risk management tools. This enables them to make informed, data-driven decisions, a valuable skill set for investment professionals.

In essence, the MBA develops versatile soft skills that are vital for leadership and relationship-building, while the CFA cultivates technical abilities suited to in-depth financial analysis and specialized roles within finance. Each designation thus caters to a different dimension of professional development, depending on the career path a candidate wishes to pursue.

Global Employer Perceptions

Employers worldwide value both the MBA and CFA designations, though regional preferences vary based on industry demands and local business practices.

Understanding these regional valuations can help candidates select the credential that aligns best with their geographic career aspirations.

Regional Valuation of MBA vs. CFA

United States: In the U.S., the MBA is highly regarded across a wide range of industries, especially for general management and leadership roles. Top MBA programs are known for their alumni networks, which provide access to influential positions within large corporations, consulting firms, and tech companies. Meanwhile, the CFA is highly valued within the finance sector, particularly in asset management, hedge funds, and investment banking, where technical expertise in investment analysis is paramount.

Europe: In Europe, the CFA designation is widely respected within finance-specific roles. Investment banks, asset management firms, and other financial institutions often prioritize the CFA for positions that demand a deep knowledge of investment practices. However, for broader leadership roles, the MBA remains preferred, especially for senior management and executive positions within multinational corporations, where the skillset and networking benefits of an MBA are considered advantageous.

Asia: Both the MBA and CFA credentials carry significant weight in Asia, with each regarded highly for its respective strengths. In finance hubs like Hong Kong, Singapore, and Tokyo, the CFA is particularly esteemed, as it signals strong financial acumen and specialization in investment management. Meanwhile, the MBA is valued across sectors for general management and entrepreneurship roles, with an emphasis on leadership and business expansion within growing economies.

The choice between an MBA and CFA can therefore be influenced by geographic location and local employer preferences, with each credential offering distinct advantages in different regions and industries.

Candidates should consider where they aim to work and the type of roles they seek to better align their choice with regional employer expectations.

Ethics and Professional Standards

Ethics form an integral part of both the CFA Program and MBA curriculum, yet the approaches differ to suit each credential’s focus and industry relevance.

While the CFA Institute’s Code of Ethics provides a globally consistent ethical framework essential for finance professionals, MBA programs incorporate ethics from a broader business and leadership perspective.

CFA Code of Ethics

Ethical Foundation: The CFA Program emphasizes ethics as a cornerstone of professional conduct, embedding the CFA Code of Ethics and Standards of Professional Conduct at every exam level. Candidates are rigorously trained to recognize and uphold ethical behavior in all financial transactions and client interactions.

Global Standards: The CFA Code of Ethics is consistent worldwide, ensuring that charterholders adhere to uniform ethical guidelines regardless of region. This global standardization reinforces trust and integrity within the financial industry, positioning CFA charterholders as ethically responsible finance professionals.

Ethics in MBA Programs

Broad Perspective: MBA programs address ethics with a wide-angle lens, covering corporate governance, social responsibility, and sustainability. Courses often explore ethical dilemmas across various industries, fostering a holistic understanding of ethics in business decision-making.

Application: Ethics training in MBA programs prepares graduates for leadership roles by addressing real-world challenges in corporate governance and corporate responsibility. This approach develops ethical leaders capable of navigating complex ethical scenarios, particularly in general management, corporate strategy, and policy development roles.

Both the CFA and MBA programs instill ethical principles but with different focal points—CFA with a finance-centric approach and MBA with a broader business perspective.

These distinctions align each credential with the ethical expectations of their respective career paths.

Testimonials

Testimonials from MBA graduates and CFA charterholders highlight the transformative impact of each credential, with success stories underscoring the unique advantages each path offers.

MBA Graduates

Career Transitions: Many MBA graduates share stories of successfully transitioning into new industries such as consulting, technology, and entrepreneurship. They credit the program’s broad business education and flexible skill set for enabling these shifts, opening doors to diverse career paths.

Networking Impact: MBA graduates often emphasize the profound influence of their school’s alumni network, where they find lifelong mentors, career-long friendships, and connections that facilitate career growth and business opportunities. These networks provide access to advice, insights, and opportunities that can accelerate career trajectories.

CFA Charterholders

Career Advancement: CFA charterholders frequently attribute their career growth to the program’s rigorous training, sharing experiences of advancing into roles like portfolio manager, risk officer, and chief investment officer. The program’s focus on finance-specific knowledge and ethics has been pivotal in establishing their expertise within the finance industry.

Credibility: CFA charterholders often report increased recognition and trust from employers and clients, given the program’s strict ethical standards and globally recognized finance acumen. This credibility enables them to stand out in competitive finance roles, where expertise and integrity are paramount.

Introspective Questions to Guide Your Decision

Making a choice between an MBA and CFA involves thoughtful reflection on personal goals and career interests.

Here are some key questions to consider:

Career Goals: What are your long-term aspirations? Are you looking to lead in a general business capacity or deepen your specialization within finance?

Passion Alignment: Are you more interested in the strategic, broad-based challenges of general business, or does your passion lie in the analytical, specialized world of finance?

Skill Development: Do you prefer developing leadership, strategic management, and networking skills, or are you drawn to building technical expertise in investment analysis, financial modeling, and ethics?

These questions can help clarify which credential aligns more closely with your professional vision and personal inclinations, guiding you toward the path that best supports your future ambitions.

Challenges to Consider

Both the MBA and CFA paths come with their own sets of challenges, often requiring a significant commitment in terms of time, finances, and personal discipline.

Here’s a breakdown of key obstacles candidates might face in each path.

Pursuing an MBA

Financial Investment: MBA programs, particularly those at top-tier institutions, involve high tuition fees, often ranging from $60,000 to over $200,000. In addition to tuition, living expenses and opportunity costs from potentially reduced work hours can contribute to financial strain, leading many students to incur substantial debt.

Time Commitment: Full-time MBA programs typically require two years of dedicated study, while part-time or executive programs extend over multiple years. For those attending full-time, this can mean taking a career break, and for part-time students, balancing work, life, and studies can become overwhelming.

Pursuing the CFA

Rigorous Exams: The CFA exams are notoriously challenging, with low global pass rates that reflect the high level of rigor in each level of the program. Many candidates find themselves dedicating over 300 hours per level, spread across months, to achieve success, and passing all three levels can take an average of 3-4 years.

Work-Life Balance: Since the CFA is a self-study program and most candidates pursue it while working full-time, finding the right balance between career, study time, and personal life is crucial. The pressure of balancing work responsibilities with the intensity of CFA preparation can be demanding and requires strong time-management skills.

These challenges highlight the importance of being prepared for the time, dedication, and sacrifices each path entails, helping potential candidates to assess whether they are ready to commit to the demands of an MBA or CFA.

Future Relevance and Adaptability

As industries evolve, professionals with adaptable skill sets are increasingly valuable.

Both the MBA and CFA programs equip candidates with competencies that extend beyond traditional roles, ensuring they remain relevant in dynamic, forward-looking sectors.

MBA Skills in Evolving Markets

Versatility: The generalist nature of the MBA prepares graduates to pivot across industries and roles, allowing them to step into leadership positions with ease. The emphasis on management, strategy, and problem-solving equips them to drive initiatives across sectors such as healthcare, technology, and consulting, adapting to the shifting demands of the business world.

Digital Proficiency: With the rapid rise of digital transformation, many MBA programs now incorporate courses on data analytics, artificial intelligence, and digital strategy. This prepares graduates for leadership roles in digital transformation, a critical capability as industries increasingly rely on technology to enhance productivity and customer engagement.

CFA Skills in Emerging Sectors

Fintech: The CFA curriculum’s strong focus on quantitative methods, investment analysis, and financial modeling is highly applicable in financial technology (fintech) and data-driven finance roles. As fintech continues to reshape the financial services industry, CFA charterholders are well-equipped to contribute to data analysis, algorithmic trading, and the development of financial technologies.

ESG Investing: Environmental, Social, and Governance (ESG) investing has gained prominence as both corporations and investors prioritize sustainability. The CFA’s emphasis on ethical standards and responsible investing aligns well with ESG trends, making CFA charterholders valuable assets in sustainable finance, impact investing, and corporate governance roles.

With these adaptable skills, MBA graduates and CFA charterholders can remain valuable players in a rapidly changing landscape, positioning themselves as leaders capable of navigating emerging industries and responding to global shifts in finance and business.

Today’s job market reflects a high demand for both MBAs and CFAs, each driven by the distinct needs of industries looking to leverage strategic business leadership or specialized financial expertise.

High-Demand Areas for MBAs

Consulting: Firms are actively seeking MBA graduates for roles in consulting due to their strategic thinking and problem-solving capabilities. Consulting positions offer opportunities to work across various industries, helping organizations tackle complex challenges and optimize operations. The ability to analyze, strategize, and implement large-scale business solutions makes MBAs a natural fit for these roles.

Technology: The tech industry increasingly values MBAs for positions in product management, business development, and strategy. As companies expand into new markets and seek innovative products, MBAs bring the business acumen required to guide product roadmaps, manage cross-functional teams, and drive growth initiatives in competitive tech landscapes.

High-Demand Areas for CFAs

Asset Management: With growing global interest in investment opportunities, CFA charterholders are in demand within asset management for roles in portfolio management, financial analysis, and investment research. Their expertise in evaluating securities and managing portfolios positions them to meet the needs of institutional and individual investors focused on achieving financial growth.

Risk Management: CFAs are also sought after in risk management roles within banks and financial institutions. As regulatory requirements and financial risks increase, CFAs’ ability to assess financial risks and develop strategies to mitigate them is highly valuable. Their deep understanding of market dynamics and quantitative skills make them instrumental in helping institutions manage and adapt to risk exposures effectively.

In line with these job market trends, both MBAs and CFAs are positioned for impactful careers that align with the needs of high-growth sectors, ensuring they remain valuable contributors to evolving economic landscapes.

Download the “70 Essential Questions to Help You Decide: CFA or MBA?” guide here to start your journey toward a more focused and informed career path.

Final Thoughts

Choosing between an MBA and a CFA is a pivotal decision, one that sets the direction for your professional journey and impacts how you contribute to your industry.

Reflect on your career goals, interests, and the kind of work that truly excites and energizes you.

An MBA might be the ideal choice if you aspire to lead organizations, tackle broad business challenges, or innovate in diverse industries.

In contrast, the CFA path is unmatched for those who want to specialize deeply in finance, analyze investments, or contribute to asset management with precision and expertise.

Consider the investment of both time and money, as well as the rigorous dedication each path demands.

Think about where you see yourself in the next five, ten, or even twenty years. Do you envision yourself leading teams, crafting strategy, or perhaps guiding clients through complex financial landscapes?

Ultimately, the right choice will align not only with your professional aspirations but also with your values and personal motivations.

Embrace whichever path resonates most with you, knowing that your commitment to growth, mastery, and purposeful work will be the true drivers of your success.

FAQs

How does the CFA program differ from the MBA in terms of curriculum focus?

The CFA program is centered around investment analysis, portfolio management, financial modeling, and ethics, with a focus on deep technical knowledge in finance. The MBA curriculum, however, covers broader business topics like marketing, operations, leadership, and strategy, with options for specialization through electives.

Is it possible to pursue both an MBA and a CFA, and if so, what are the benefits?

Yes, many professionals pursue both. The combination offers in-depth finance expertise (CFA) and broad business leadership skills (MBA), which can lead to high-level roles in finance, consulting, and corporate leadership by demonstrating both technical proficiency and strategic understanding.

How does each designation impact career advancement opportunities?

An MBA often fast-tracks advancement in corporate and leadership roles across various industries, while the CFA typically accelerates career growth within finance-specific roles, particularly in investment management, equity research, and asset management.

What types of job roles do CFA charterholders typically pursue?

CFA charterholders commonly pursue roles in investment banking, portfolio management, equity research, and risk management. They are often seen in asset management firms, hedge funds, investment banks, and financial advisory roles.

What are the top industries hiring MBA graduates?

MBA graduates are highly sought after in consulting, technology, finance, healthcare, and manufacturing. Companies in these sectors value MBA graduates for their problem-solving skills, business acumen, and leadership potential.

How do networking opportunities compare between MBA programs and the CFA Institute?

MBA programs often offer extensive global alumni networks with career services and recruitment events. CFA charterholders benefit from networking through local CFA societies, which provide industry-specific events, career resources, and a strong finance-focused community.

Which designation requires a greater financial investment, and what does this include?

An MBA generally requires a larger financial investment, with tuition ranging from $60,000 to $200,000+ and additional costs for materials and living expenses. The CFA is less costly, with exam fees totaling $2,400 to $4,500, excluding study materials.

How long does it typically take to complete the MBA vs. the CFA?

An MBA usually takes two years for a full-time program, while the CFA typically takes about three to four years, as candidates often take one year per exam level while working full-time.

Which program offers more flexibility for working professionals?

The CFA program is structured as a self-study program, allowing candidates to study independently while working. Many MBA programs also offer part-time or executive formats for working professionals, though they require regular class attendance.

How important are ethics in the CFA program compared to MBA programs?

Ethics are central to the CFA program, with a dedicated section on the CFA Code of Ethics and Standards of Professional Conduct at every exam level. In MBA programs, ethics are also covered but as part of a broader perspective on corporate governance, social responsibility, and ethical leadership.

What skills are commonly developed through an MBA that are not a focus in the CFA program?

An MBA helps build soft skills such as leadership, communication, negotiation, and team collaboration, which are essential for management and executive roles. The CFA, on the other hand, emphasizes technical financial skills.

Which designation is more specialized, and what areas does it cover?

The CFA is more specialized, covering topics directly related to finance, like investment analysis, portfolio management, and quantitative methods. The MBA is broader, covering multiple business disciplines and allowing for a diverse career path.

How does the job market value each designation in the United States versus Europe and Asia?

In the United States, MBAs are highly valued across industries, while in Europe, CFAs are preferred for finance roles and MBAs for leadership. In Asia, both designations are respected, with CFAs highly regarded in finance centers like Hong Kong and Singapore.

How do pass rates for CFA exams compare to completion rates for MBA programs?

CFA exams have relatively low pass rates, with each level presenting rigorous challenges, while MBA programs typically have high completion rates once admitted, though academic performance and participation are key to success.

What roles do MBA graduates typically take on in the technology sector?

MBA graduates in the technology sector often work in product management, strategy, business development, and operations, where they apply their problem-solving and leadership skills to drive growth and innovation.

What are the main challenges someone might face when pursuing the CFA?

The CFA requires a strong commitment to self-study, a high level of discipline, and often involves balancing work and life responsibilities with a demanding study schedule. The rigorous exams and technical material can be challenging.

How does each program adapt to changes in the job market, such as the rise of fintech or ESG?

MBA programs increasingly integrate courses on digital transformation, technology, and ESG (Environmental, Social, Governance) issues. The CFA program has also adapted by incorporating ESG and fintech topics, focusing on their relevance to investment management.

Can earning a CFA lead to opportunities outside of traditional finance roles?

Yes, while it’s most common in finance, CFA charterholders can find roles in fintech, ESG-focused companies, and consulting, where their investment and financial analysis skills are increasingly valued in data-driven decision-making.

What are the benefits of an MBA for someone interested in entrepreneurship?

An MBA provides a structured approach to business planning, marketing, finance, and operations, essential for launching or scaling a business. It also provides access to incubators, venture capital networks, and entrepreneurial competitions.

How can professionals decide which designation best aligns with their career goals?

Professionals should reflect on their career interests, desired industry, preferred skills (technical vs. leadership), and long-term goals. If they aim for a specialized finance role, the CFA may be more suitable, while an MBA is ideal for broader business leadership or career shifts across industries.

Glossary

Investment Analysis: The process of evaluating financial assets to make informed investment decisions.

Financial Modeling: Creating a numerical representation of a company’s financial performance to forecast future outcomes.

Portfolio Management: The art of selecting and overseeing a collection of investments to meet specific financial goals.

Equity Research: Analyzing companies and their stock performance to guide investment decisions.

Asset Management: Managing financial assets for clients to grow and protect their wealth over time.

Risk Management: The practice of identifying, assessing, and mitigating financial risks in investment and business decisions.

Quantitative Methods: Using mathematical and statistical models to analyze data and make finance-related predictions.

Ethics: Moral principles and guidelines governing professional conduct and decision-making.

Networking: Building professional relationships that can lead to new career opportunities and business insights.

Alumni Network: A community of former students from a particular school, offering support and career connections.

CFA Charterholder: A finance professional who has completed all three levels of the CFA exams and met work requirements.

MBA Graduate: An individual who has completed a Master of Business Administration program, focusing on business and management.

Specialization: Focusing on a specific area of study within a broader program or field to gain deeper expertise.

Case Study: A detailed analysis of a real-life scenario used for educational or training purposes.

Self-Study: Studying independently, often with provided materials, rather than through formal classes.

Pass Rate: The percentage of candidates who successfully pass an exam within a given period.

Capital Markets: Markets where people trade financial securities, like stocks and bonds, to raise capital.

Valuation: The process of determining the current worth of an asset or company.

Return on Investment (ROI): A measure of the profitability of an investment, calculated as a percentage of the original cost.

Fintech: Technology-driven solutions in the financial sector, including mobile payments, blockchain, and digital banking.

ESG Investing: Investment approach that considers Environmental, Social, and Governance factors alongside financial returns.

Work-Life Balance: The balance between professional responsibilities and personal life to maintain well-being.

Digital Transformation: The integration of digital technologies into business processes to improve performance.

Product Management: Overseeing the development and success of a product throughout its lifecycle.

Corporate Governance: The system of rules and practices that guide a company’s operations and ethical conduct.