Deciding between the CFA (Chartered Financial Analyst) designation and an MBA (Master of Business Administration) can feel like a crossroads for professionals in finance and business.

Each path has its own merits, catering to different career goals, skill sets, and aspirations.

But how can you determine which choice will be the best fit for your unique situation?

If you’ve been wrestling with this decision, we’ve got a powerful tool that can help. We’ve created an in-depth guide titled, “70 Essential Questions to Help You Decide: CFA or MBA?”

This guide is a curated collection of the most insightful questions across 14 categories, designed to prompt self-reflection and give you the clarity needed to make an informed choice.

Dedicating a few hours to these questions could save you years of potential regret, unnecessary costs, and wasted time.

Download the “70 Essential Questions to Help You Decide: CFA or MBA?” guide here to start your journey toward a more focused and informed career path.

Why This Guide Matters

The CFA and MBA paths are both demanding – but they lead to different outcomes.

The CFA focuses intensely on financial analysis and investment management.

An MBA offers a broader business education with opportunities to develop management and leadership skills.

By working through this guide, you’ll have the chance to assess each credential’s relevance to your own career goals, lifestyle needs, and future ambitions.

Doozy Digest

A newsletter for CFA candidates

Subscribe for:

✔ Insightful tips

✔ Expert advice

✔ Career motivation

✔ Exam inspiration

Stay updated and subscribe today!

What You’ll Find Inside

The guide is divided into the following sections, each tackling a critical aspect of the CFA vs. MBA decision:

Personal and Professional Goals – Define your career vision and evaluate how each path aligns with your ambitions.

Current Career Situation – Reflect on your present role and skill set to determine the best way forward.

Desired Industry and Function – Examine your industry preferences and the specific roles you aspire to.

Professional Network and Relationships – Explore how each credential could expand your professional connections.

Learning Preferences and Study Commitments – Consider the study styles and academic rigor required by each path.

Skills and Knowledge Focus – Identify the specific skills that each program can help you develop.

Financial Investment and Cost-Benefit Analysis – Weigh the costs, expected ROI, and the potential financial impact.

Time and Life Commitment – Assess how each path would affect your work-life balance and personal life.

Career Mobility and Flexibility – Understand how each credential impacts career flexibility within and outside your current industry.

Long-Term Earnings Potential and Job Stability – Analyze each option’s impact on long-term earnings and job security.

Career Advancement and Leadership Opportunities – Evaluate how each credential can influence leadership roles and career progression.

Work-Life Balance and Lifestyle Impact – Consider how each path may affect work-life balance and quality of life.

Global Recognition and Geographic Relevance – Investigate the recognition and value of each credential across regions.

Decision-Making Self-Reflection – Reflect on your motivations, aspirations, and commitment comfort level.

How to Use This Guide

Set aside a few hours in a quiet space where you can focus.

As you answer each question, take notes and be honest with yourself.

You may find certain questions resonate deeply with your goals and others reveal unexpected priorities.

By the end, you’ll have a much clearer idea of which path aligns with your career aspirations and lifestyle.

Get Started

Choosing between the CFA and MBA is a monumental decision, but it doesn’t have to be overwhelming.

With “70 Essential Questions to Help You Decide: CFA or MBA?”, you’ll have a step-by-step roadmap to guide your decision, ensuring that the path you choose aligns with your unique strengths, values, and ambitions.

Download the guide now and take the first step towards a more focused, fulfilling, and successful career journey.

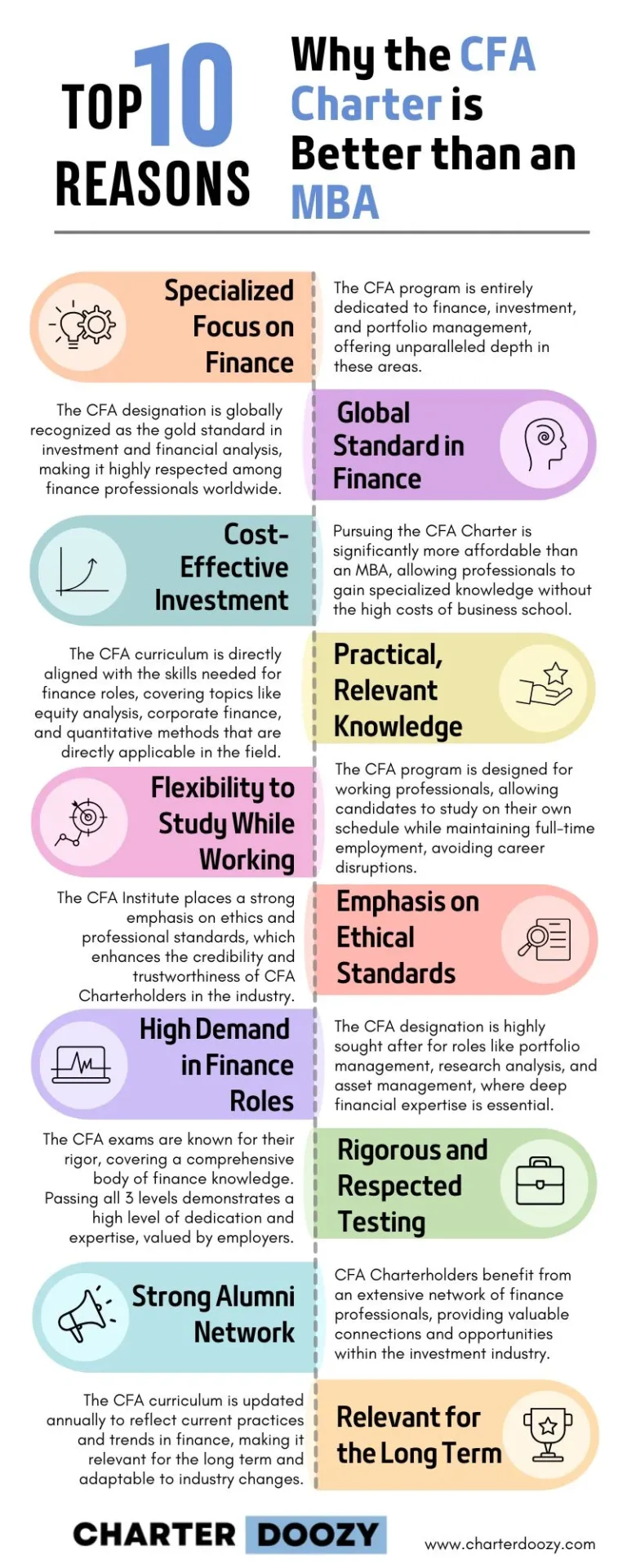

Alternatively, Read our Top 10 Reasons Why the CFA Charter is Better Than an MBA.

Personal and Professional Goals: Assessing Short-Term and Long-Term Career Objectives

- What is my ultimate career vision, and what specific role or position do I aspire to hold in 5, 10, or even 20 years?

- Do I see myself in a specialized role focused on finance or analysis (such as asset management, investment analysis), or in a broader business management or strategic leadership role?

- Am I more drawn to technical, analytical work or to roles that require broader managerial and leadership skills?

- What are my specific career goals over the next three years, and which credential would help me achieve them sooner?

- Do I aspire to work within a specific industry (such as investment banking, asset management, or corporate finance) that might favor one credential over the other?

- What types of companies or organizations do I want to work for (e.g., banks, consulting firms, multinational corporations, start-ups), and what credentials do they value?

- Am I more passionate about solving financial problems or about understanding and leading the bigger picture of business operations?

- Do I plan to eventually transition into entrepreneurship or start my own business, and which credential would best support that ambition?

- How adaptable do I want my career to be? Would I like the flexibility to move between different roles or industries?

- How important is global mobility, and will either credential open more opportunities internationally?

Current Career Situation: Evaluating Your Present Role, Skills, and Industry Expectations

- What are the biggest gaps in my current skill set, and how could each credential help bridge those gaps?

- How would my current employer view each credential, and which would be more valued for career advancement within my organization?

- How much support (financial, time flexibility) would my employer offer if I pursued either the CFA or MBA?

- Are there colleagues in similar roles who have either a CFA or MBA, and what impact has it had on their career progression?

- Does my current position allow for the time and flexibility required to pursue either credential?

- How stable and future-proof is my current field, and would gaining a CFA or MBA provide additional job security?

- How does my current compensation compare to others with a CFA or MBA in similar roles within my industry?

- Am I satisfied with my current trajectory, or do I feel that a change is necessary for long-term fulfillment, and would either the CFA or MBA support this shift?

Desired Industry and Function: Understanding the Industries and Roles You Are Most Interested in Pursuing

- Which industries am I most passionate about, and would the CFA or MBA provide more credibility within those fields?

- Do I envision myself in a specialized finance role or a broader business leadership role, and which credential aligns with that?

- What are the most in-demand skills within my target industry, and which credential offers a stronger foundation in those areas?

- Is my desired role more technical or strategic, and does either credential better serve that need?

- What type of function or department (e.g., finance, operations, consulting) excites me most, and would the CFA or MBA better prepare me for it?

Professional Network and Relationships: Exploring the Value of Alumni Networks, Mentorship, and Connections

- How important is having a strong, supportive professional network to my career success?

- Do I want to build relationships with peers from diverse industries (more common in MBA programs) or primarily within finance (more common with the CFA)?

- Would the CFA or MBA credential give me access to a network that aligns with my industry goals?

- Are there professional groups, clubs, or associations affiliated with either credential that would help me expand my connections?

- Would networking and relationship-building opportunities in an MBA cohort better support my future goals?

Learning Preferences and Study Commitments: Considering Study Preferences, Time Management, and Academic Rigor

- Do I prefer structured, classroom-based learning (common in MBA programs) or self-directed study (typical for the CFA)?

- How comfortable am I with independent study, or do I need deadlines and peer accountability to stay motivated?

- Would I benefit from case-based, discussion-oriented learning found in an MBA, or do I prefer a more fixed curriculum like the CFA?

- Do I have the discipline to commit to multi-year study schedules?

- How well do I handle stress from high-stakes exams (CFA) versus a mix of projects and exams (MBA)?

Skills and Knowledge Focus: Defining the Hard and Soft Skills You Need to Build for Your Future Goals

- What specific technical skills (e.g., financial modeling, data analysis) do I need to develop, and would the CFA or MBA be more effective for these?

- Do I need stronger leadership and management skills, and would an MBA’s emphasis on teamwork and leadership training be more beneficial?

- Am I aiming to improve my quantitative and analytical skills, and would the CFA’s focus on finance better meet this need?

- Do I need a strong foundation in business fundamentals like strategy, marketing, and operations that an MBA provides?

- Would specialized finance knowledge from the CFA help me more than the MBA’s broad approach?

Financial Investment and Cost-Benefit Analysis: Weighing Costs, Expected ROI, and Potential Financial Impact

- What is the total financial cost of pursuing the CFA versus the MBA, including tuition, exam fees, materials, and supplementary resources?

- Can I afford the upfront costs of an MBA program, or would the lower cost of the CFA program be a better fit?

- What are the average salary expectations for CFA Charterholders compared to MBA graduates in my industry?

- Would either credential lead to faster career progression and ROI?

- Am I willing to take on debt if I pursue an MBA, and how would that impact my long-term financial goals?

Time and Life Commitment: Assessing Time Requirements, Opportunity Costs, and Balancing Responsibilities

- How many hours per week can I realistically dedicate to studying or attending classes without compromising my well-being?

- Does my current job allow flexibility to pursue either program?

- Am I willing to sacrifice personal or leisure time to meet the demands of either program?

- Are there life events (e.g., marriage, children) that could impact my ability to complete the CFA or MBA?

- Do I have the time management skills to balance work, study, and personal obligations successfully?

Career Mobility and Flexibility: Evaluating How Each Credential Affects Industry Mobility and Career Flexibility

- Would the CFA or MBA make it easier to switch roles or industries if I decide to make a career change?

- Would an MBA provide a broader foundation that offers flexibility across business functions, or would the CFA be better for a specialized finance role?

- Which credential offers stronger recognition and employability in different regions where I might want to work?

- How much value do I place on the flexibility to move between various sectors or functions in my career?

Long-Term Earnings Potential and Job Stability: Analyzing Impact on Earnings Growth and Job Security

- Which credential typically leads to higher salary growth over the next 5, 10, and 20 years?

- How does each credential impact job stability across economic cycles?

- Are CFA Charterholders or MBA graduates generally more employable in volatile job markets?

Career Advancement and Leadership Opportunities: Understanding the Influence on Career Progression

- How much does career advancement depend on my technical vs. leadership skills, and which credential better supports these?

- Do CFA Charterholders or MBAs more commonly hold leadership positions in my industry?

- Which credential provides a stronger foundation for future leadership roles?

Work-Life Balance and Lifestyle Impact: Considering How Each Path Affects Balance and Quality of Life

- How important is maintaining a balanced lifestyle during studies, and would the CFA or MBA better support that balance?

- Would either credential disrupt my current work-life balance or quality of life?

- How likely is burnout, and do I feel prepared to manage the risks associated with each path?

Global Recognition and Geographic Relevance: Investigating Recognition and Value Across Regions

- Is the CFA or MBA more widely recognized and valued in my current country or region?

- Which credential would be more transferable if I relocate internationally?

- Are there specific geographic areas where either credential holds more prestige?

Decision-Making Self-Reflection: Reflecting on Motivations, Aspirations, and Commitment

- What are my primary motivations for pursuing a new credential—career advancement, financial gain, personal growth?

- Would I regret not pursuing a CFA or MBA if I don’t seize the opportunity now?

- Am I comfortable with the commitment each credential requires?