Show me a portfolio, and I’ll show you the mind of its creator.

On Wall Street, there’s an old truth whispered in the halls of power…

It’s not about picking the perfect stock.

It’s about architecting the perfect mix of assets that can survive any storm.

Yet in every bull market, investors chase headlines and hot tips, enthralled by the dream of a single trade that changes their destiny. But professionals (those managing billions, with careers on the line) know a different reality…

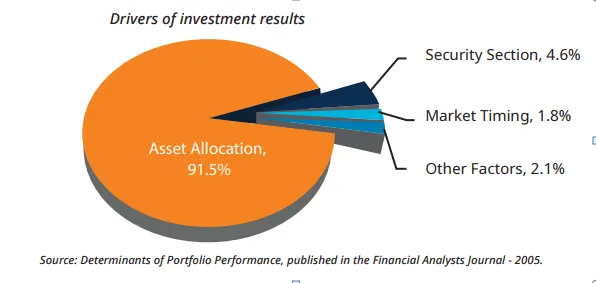

Asset allocation is the single biggest driver of portfolio results.

Period.

Is that hyperbole?

Hardly.

Reams of research, from Brinson, Hood & Beebower’s seminal work in the 1980s to modern studies, confirm it

80-90% of the variability in long-term portfolio returns comes from asset allocation.

Not from heroic stock picking.

Not from market timing.

Not from spotting the next unicorn IPO.

That’s why the sharpest minds in finance (CIOs, asset allocators, portfolio managers) spend sleepless nights wrestling with the same question…

How do we allocate capital across a chaotic, uncertain world?

Let’s dive deeper.

Because if you’re a CFA candidate, finance professional, or simply an investor who refuses to be average, you need to understand that asset allocation isn’t a theoretical exercise.

It’s the fine line between career-making brilliance and catastrophic loss.

How the CFA Curriculum Builds Asset Allocation Mastery

Asset allocation sits like a throne at the center of the CFA Level III curriculum.

Why?

Because this is the moment where pure theory collides with the real world’s messy truth.

Level I and II teach you to dissect securities. You learn how to model earnings, calculate duration, price options. But Level III is where you transform all that knowledge into one coherent portfolio that must:

- Achieve a client’s goals

- Survive macroeconomic shocks

- Respect regulatory constraints

- Anticipate behavioral pitfalls

Laying the Groundwork: CFA Level I

The journey toward mastering asset allocation in the CFA Program begins at Level I, where candidates are introduced to the fundamental language and tools of investing. While asset allocation itself isn’t yet studied as a separate discipline, the building blocks are firmly established.

Candidates learn how to measure risk and return, understand key statistical concepts like correlation and standard deviation, and explore the basic features of major asset classes such as equities, fixed income, and alternatives.

This foundation is essential because it teaches future professionals how to speak the language of finance and lays the groundwork for understanding how different assets interact within a portfolio.

Diving Deeper: CFA Level II

Level II takes the technical knowledge from Level I and expands it into a detailed exploration of how individual asset classes are valued and analyzed.

Here, candidates study complex valuation techniques for equities, fixed income securities, derivatives, and alternative investments.

Understanding how each asset class is priced and what drives its risk and return characteristics becomes crucial, because these insights ultimately inform the inputs (such as expected returns, volatility, and correlations) that feed into asset allocation models. Level II also introduces more advanced quantitative methods, equipping candidates with tools to analyze historical data and identify relationships among financial variables.

Integrating Knowledge: CFA Level III

The transformation from analyst to portfolio architect truly happens at Level III. This is where the curriculum shifts from studying individual securities to constructing comprehensive investment solutions for clients.

Asset allocation becomes a central theme, with the curriculum covering topics like strategic and tactical allocation, liability-driven investing, and incorporating behavioral finance insights into portfolio decisions.

Candidates learn to write investment policy statements, develop capital market expectations, and design portfolios tailored to specific client objectives, constraints, and risk tolerances. The emphasis moves from understanding financial instruments in isolation to combining them into portfolios that can achieve real-world financial goals.

Connecting Theory to Practice

One of the most important aspects of the CFA curriculum is how it methodically connects theory to practical portfolio management. The progression from Level I through Level III ensures that candidates not only understand how to analyze and value individual assets but also how to assemble those pieces into a coherent, risk-aware portfolio.

The knowledge gained in earlier levels (whether it’s statistical tools, valuation techniques, or performance metrics) feeds directly into the practical skills needed to make sound asset allocation decisions. By Level III, candidates are expected to think like chief investment officers, weighing macroeconomic views, client psychology, and regulatory considerations to construct robust portfolios.

The Result | Professionals Who Can Allocate Capital Wisely

Ultimately, the CFA Program’s tiered structure ensures that asset allocation expertise is built progressively and systematically. Level I provides the essential tools and concepts, Level II sharpens analytical and valuation skills, and Level III brings everything together into practical portfolio construction and asset allocation.

This careful progression transforms candidates from students of finance into professionals capable of making sophisticated, high-stakes decisions about how capital should be allocated across a complex and ever-changing investment landscape.

The CFA Charterholder emerges as someone prepared not just to analyze markets but to build resilient, purposeful portfolios for clients around the world.

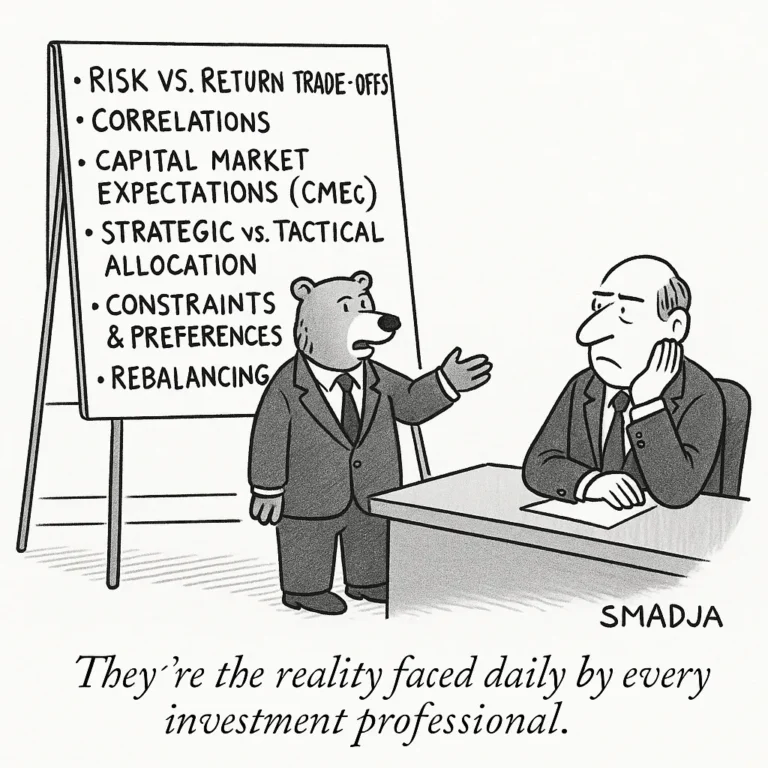

The CFA curriculum hammers home all the foundational principles…

- Risk vs. Return Trade-offs → There’s no free lunch.

- Correlations → Everything you thought was uncorrelated… might not be when the world burns.

- Capital Market Expectations (CMEs) → Good luck forecasting the next decade of returns.

- Strategic vs. Tactical Allocation → Are you disciplined, opportunistic, or both?

- Constraints & Preferences → Every client is a snowflake… with sharp edges.

- Rebalancing → The quiet discipline that saves portfolios from drifting into risk oblivion.

These are not academic curiosities. They’re the reality faced daily by every investment professional…

…from the junior quant building CMEs in Excel, to the CIO defending allocations before a skeptical board.

Inside the War Room | How CIOs Actually Allocate

In textbooks, asset allocation looks tidy.

Plug assumptions into a mean-variance optimizer, press “Run,” and out pops a beautiful pie chart:

Perfect. Elegant. Useless.

Because in practice, CIOs inhabit a world far messier, governed by a blend of math, art, psychology, and institutional politics.

Consider just a few real-world tensions…

Macro Views vs. Model Outputs

A CIO may overweight emerging markets equities because they believe global growth is shifting east. But if the model screams “US equities only,” who wins? Data or intuition?

Institutional Context

A corporate pension fund facing payouts in five years cannot afford to lock up 40% of assets in private equity. Meanwhile, a university endowment with a 100-year horizon can. Context is everything.

Behavioral Realities

Clients panic. Boards panic. Trustees panic. A CIO’s real job is often behavioral risk management—constructing allocations that clients can stick with, even when blood runs in the streets.

Regulation

Insurance companies face solvency constraints dictating how much risk they’re allowed to hold. Sometimes the perfect portfolio is simply illegal.

So in the real world, CIOs constantly ask…

The Rise of Alternatives | Redrawing the Map

No revolution has reshaped asset allocation more profoundly than the rise of alternatives. The 60/40 portfolio is no longer gospel.

Hedge funds, private equity, private credit, infrastructure, real estate—they’ve moved from exotic side dishes to the main course for many institutions.

Consider David Swensen’s Yale Endowment model. Under his stewardship, Yale’s portfolio morphed into a mosaic of:

- Private equity

- Hedge funds

- Real assets

- Minimal public equity exposure

Swensen’s legacy sparked debates that rage to this day:

- Should retail investors have access to illiquid, complex assets?

- Do the fees and opacity justify the potential excess returns?

- How do you value private assets in volatile markets?

Alternatives offer potential return enhancement and diversification. But they come at a cost:

- Illiquidity risk

- Higher fees

- Complex valuation

- Performance dispersion (not all private equity managers are equal)

A skilled CIO must weigh these factors carefully… especially under the relentless scrutiny of investment committees demanding transparency and justification for every basis point of underperformance.

Strategic vs. Tactical Allocation | The Eternal Debate

This is one of asset allocation’s bloodiest battlegrounds:

- Strategic Allocation → Define your long-term asset mix based on risk tolerance and objectives. Stick to it through thick and thin.

- Tactical Allocation → Tilt the portfolio away from long-term targets to exploit short-term opportunities.

In theory, tactical shifts sound enticing. In practice, they can be career-ending. Consider the 2008 financial crisis:

- Some managers went defensive early and avoided catastrophic losses.

- Others stayed invested and suffered—but participated fully in the rebound.

- Meanwhile, many who tried to time the bottom missed the fastest bull run in history.

This tension between discipline and opportunism is one CFA Level III candidates must grapple with… because it’s the same question every CIO faces every day.

Market Crises | The Crucibles of Asset Allocation

History has forged asset allocation through fire.

Each crisis leaves scars (and wisdom)…

The Dot-Com Bubble (2000)

Investors overweighted tech. Diversification seemed pointless… until the crash vaporized trillions in market cap. Lesson: never anchor your portfolio to a single narrative.

The Global Financial Crisis (2008)

Asset classes once thought uncorrelated (like equities and commodities) collapsed in unison. Investors discovered that…

This fueled interest in alternatives and risk-factor diversification.

COVID Crash (2020)

Markets fell off a cliff… then roared back in record time. Investors who stuck with strategic allocations recovered. Those who fled to cash often locked in losses and missed the rebound.

Each of these events rewrote assumptions about risk, diversification, and investor behavior. Ignore their lessons at your peril.

Careers Where Asset Allocation Is Life or Death

Asset allocation is not some dusty textbook topic. It’s the beating heart of countless finance careers:

Asset Managers & CIO Offices

Large asset managers (BlackRock, Vanguard, Fidelity) have multi-asset teams crafting strategic and tactical allocations. Junior analysts build capital market assumptions. Senior professionals defend those views before skeptical boards.

Wealth Management

In private banking, asset allocation underpins every client conversation. High-net-worth clients want exposure to private equity or hedge funds – but also want to sleep at night. Advisors must bridge technical mastery with human empathy.

Investment Consulting

Firms like Mercer, Willis Towers Watson, and Cambridge Associates guide pensions, endowments, and sovereign wealth funds. Consultants must translate theory into practical, actionable advice for institutions under immense fiduciary pressure.

Corporate Treasury & Pension Funds

Even CFOs deal with asset allocation. Managing corporate cash or pension assets involves balancing risk, liquidity, regulatory constraints, and expected returns.

Debates Roiling the World of Asset Allocation

Asset allocation may feel like settled science. It isn’t. Some of today’s fiercest debates include:

- Active vs. Passive Allocation → Should we tilt tactically or stay disciplined?

- Death of 60/40? → Rising rates threaten bonds. Is the classic portfolio obsolete?

- Retail Access to Alternatives → Democratization of private markets, or regulatory disaster waiting to happen?

- Factor Investing vs. Traditional Asset Classes → Should we allocate by asset class or by factors like value, momentum, and carry?

These debates ensure asset allocation remains thrilling, controversial, and utterly essential to the profession.

Mastering Asset Allocation as a CFA Candidate

Here’s how to turn asset allocation from an intimidating topic into your personal edge:

See the Big Picture

Don’t just memorize facts. Understand how asset allocation connects to risk, client goals, and market realities.

Practice Essay Questions

Level III is notorious for its essay section. Write concise, reasoned responses explaining why you’d choose certain allocations.

Beware the Optimization Trap

Mean-variance optimizers spit out elegant answers. But real-world portfolios must be robust, not perfect. Simplicity and resilience often beat elegance.

Connect the Dots

Asset allocation weaves through capital market expectations, behavioral finance, and risk management. Draw these threads together.

Never Ignore Behavior

A brilliant allocation fails if clients abandon it in fear. Behavioral resilience is as important as mathematical precision.

How to Talk About Asset Allocation in Interviews

Discussing asset allocation well can set you apart:

~ Avoid parroting textbook definitions. Talk about real-life challenges: client emotions, regulatory constraints, institutional politics.

~ Offer opinions. Interviewers love candidates with informed, thoughtful views on alternatives, factor investing, or tactical allocation.

~ Use examples. Reference history, like the Yale Endowment, or recent crises, to show practical understanding.

~ Demonstrate humility. The best allocators know that certainty is an illusion. Markets will humble everyone eventually.

Recommended Resources

Books-

- Expected Returns – Antti Ilmanen

- Unconventional Success – David Swensen

- The Intelligent Asset Allocator – William Bernstein

Papers:

- Brinson, Hood & Beebower’s research on return variability

- CFA Institute Research & Policy Centre reports on portfolio construction

Podcasts:

Final Word

Amid the noise of hot stock tips, crypto moonshots, and CNBC ticker tape, one truth remains:

It’s the discipline that protects your capital when the world goes mad. It’s the architecture that builds fortunes, preserves institutions, and allows clients to sleep at night.

If you’re a CFA candidate, embrace asset allocation not as a test topic—but as your professional superpower. Master it, and you’ll think like a true investment professional. Ignore it, and you’ll forever be chasing trades while others quietly build wealth.

Stay curious. Stay skeptical.

And remember… markets change, but the logic of asset allocation endures.