Here’s one of modern finance’s enduring paradoxes…

Managing billions often comes down to managing human fear.

We imagine billionaires as rational and dispassionate, presiding over spreadsheets and balance sheets from private jets. Yet even the ultra-wealthy can be driven to panic at the flicker of a red arrow on their trading screens.

The difference is that when they call you, the sums at stake (and the consequences) are staggering.

Welcome to private wealth management for the ultra-high-net-worth (UHNW). It’s a world that blends finance, psychology, geopolitics, law, and occasionally, raw human drama. The headlines may glitter with yacht regattas and art auctions, but the reality is a high-stakes chess game where errors can cost tens or hundreds of millions… or fracture entire family dynasties.

This is not a corner of finance you merely study to pass the CFA exam. It’s a domain where deep technical mastery must be matched with emotional intelligence and unflinching discretion.

Private Wealth Management in the CFA Curriculum

At CFA Level III, candidates transition from the impersonal realm of institutional portfolio theory into intensely personal financial territory.

Suddenly, your textbooks talk about human capital, cross-border taxation, multi-generational wealth transfer, and how idiosyncratic biases can torpedo even the most elegantly constructed Investment Policy Statement (IPS).

This shift is deliberate.

Private wealth is one of the fastest-growing arenas in global finance, fuelled by tech unicorns, private equity liquidity events, and the largest intergenerational wealth transfer in history.

The CFA Institute knows that managing billion-dollar family fortunes requires a skillset distinct from running a pension fund or an endowment.

It’s a specialization as technical as it is human… and one where your ability to navigate ambiguity often defines your value.

Beyond the Textbook | The Reality of Serving the Ultra-Wealthy

A Client Like No Other

Consider a real-world composite: a 45-year-old founder who’s just exited a start-up for $300 million. He’s allergic to bonds, obsessed with minimizing taxes, wants to launch a climate foundation, and insists he’ll retire in two years – unless he starts a new venture. His spouse is a foreign national > his children live on two continents > he’s contemplating a move to Switzerland. He recently acquired a Banksy and a fractional interest in a Gulfstream G650.

This client doesn’t fit into neat institutional asset allocation models. His life is a tangled web of liquidity events, cross-border tax implications, charitable aspirations, and deep-seated personal anxieties about wealth.

Your job isn’t merely to “beat the S&P 500.”

It’s to architect a financial fortress that reflects this unique mosaic of aspirations, risks, and potential crises.

This is why private wealth is part art, part science. And why many advisors will tell you the true job description is 50% finance, 50% therapy.

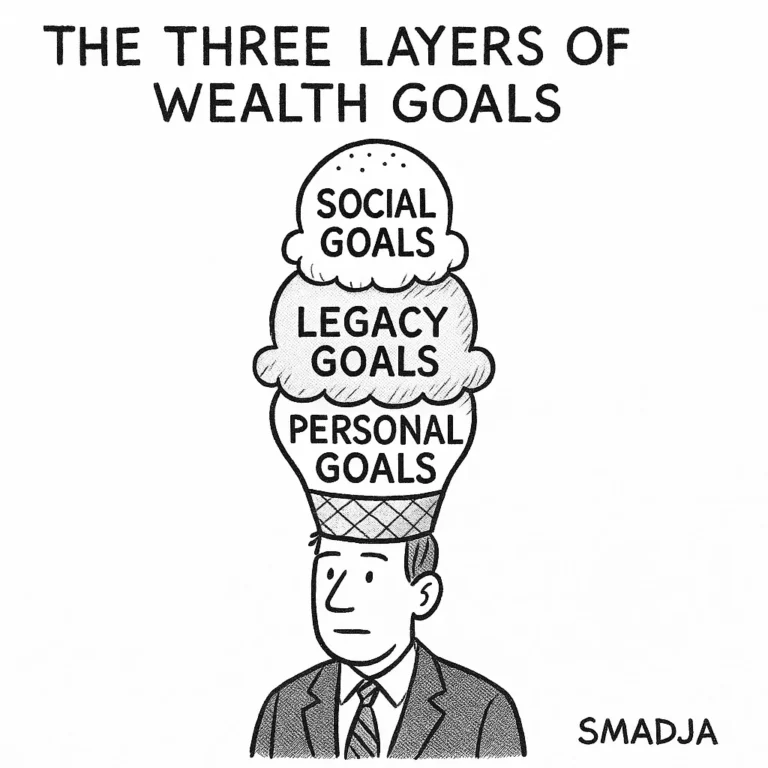

The Three Layers of Wealth Goals

One of the CFA curriculum’s most powerful insights is that UHNW individuals rarely think of wealth as a single objective. Instead, their goals fall into three interconnected spheres:

- Personal Goals: Sustaining a lifestyle, securing children’s education, or acquiring trophy assets like art or property.

- Legacy Goals: Ensuring wealth survives for heirs, maintaining family businesses, or creating philanthropic legacies.

- Social Goals: Driving social change, influencing public policy, or cementing a personal brand through visible impact.

And these goals often conflict. A billionaire might willingly sacrifice portfolio alpha to invest in ESG ventures aligned with personal values… or pour millions into philanthropic endeavors while simultaneously deploying aggressive tax minimization strategies.

Advisors who fail to map these layered goals into portfolio design risk not only poor client outcomes… but losing the client altogether.

The Emotional Undercurrents of Wealth

Here’s a counterintuitive truth…

Many UHNW clients are haunted by the specter of losing it all.

Especially first-generation wealth creators, whose memories of building their fortunes are etched with risk, sacrifice, and sometimes luck. For them, financial risk can trigger visceral, almost existential dread.

Conversely, others wrestle with guilt over wealth, or explosive family dynamics. Money is never just money > it’s often a cipher for power, identity, and legacy.

The role of a private wealth advisor frequently spills into family dynamics, requiring fluency in mediation, governance, and sometimes psychological triage.

The CFA curriculum (especially the Specialist Pathway in Private Wealth) rightly emphasizes behavioral finance in private wealth management.

It’s more than academic theory.

It’s a survival tool for keeping wealthy clients from making catastrophic, emotionally-driven decisions.

Real-World Case Studies | Wealth, Complexity, and Drama

For all its glamour, the world of ultra-high-net-worth wealth management is littered with cautionary tales…

… and illuminated by shining examples of stewardship and purpose. The stakes are colossal, the risks often hidden, and the consequences of failure can be devastating both financially and personally. True mastery in private wealth comes from studying not only markets and instruments, but the human stories of fortunes won, squandered, preserved, or transformed.

Consider the spectacular unraveling of Patricia Kluge, who once commanded a fortune thanks to her high-profile divorce from media tycoon John Kluge. Flush with cash, she poured millions into an opulent Virginia vineyard and estate. Yet when the 2008 crisis struck, sales evaporated, credit lines tightened, and her dream collapsed into foreclosure. Her story stands as a stark reminder that even “real” assets like land and luxury goods carry enormous liquidity risk… and that leveraging wealth, however vast, can become a trap when cash flows dry up.

Contrast this with the philanthropic legacy of Chuck Feeney, co-founder of Duty Free Shoppers, who quietly gave away his $8 billion fortune during his lifetime. Feeney, who lived in a modest apartment and wore a plastic watch, channeled his wealth into education, public health, and human rights causes. His belief in “giving while living” became a model for modern philanthropy. For advisors, his example underscores that private wealth management is not just about preserving capital—it’s about translating wealth into purpose, values, and long-term social impact.

Yet even billionaires who plan meticulously can face daunting complexity. After the death of Microsoft co-founder Paul Allen, his estate (estimated at over $20 billion) became entangled in an intricate web of trusts, LLCs, art collections, sports teams, and philanthropic commitments. Despite expert planning, executing his wishes has proven an immense logistical challenge, demonstrating that UHNW estate planning must not only be technically sound but operationally feasible to avoid years of administrative burden and legal costs.

Family dynamics, meanwhile, can be wealth’s silent saboteur. The Gucci family saga (now made famous by the 2021 film House of Gucci) reads like a Shakespearean tragedy: bitter lawsuits, boardroom coups, and the murder of Maurizio Gucci orchestrated by his ex-wife. These events ultimately forced the family out of the luxury fashion empire bearing their name. No matter how valuable a business or how vast the assets, misaligned goals and festering resentments can fracture both families and fortunes. For private wealth advisors, it’s a sobering illustration that governance structures and open communication are as vital as investment strategies.

Yet amid cautionary tales, there are stories of visionary stewardship. Michael Bloomberg, having amassed billions through his financial data empire, has already donated over $15 billion to causes spanning public health, climate change, and education. His philanthropy is not largesse… it’s strategically deployed capital meant to achieve specific policy outcomes. For advisors, Bloomberg’s example reinforces that UHNW clients often measure success not only in portfolio returns but in influence, legacy, and the ability to shape the world beyond themselves.

These stories drive home a central truth >>> private wealth management is never purely financial.

It is an arena where technical precision collides with human ambition, fear, and frailty.

Advisors who understand the lessons behind both triumph and disaster are better equipped to navigate their clients through the maze of ultra-high-net-worth finance – and to help them write stories that endure.

Voices Shaping the Future of Private Wealth

While the world of ultra-high-net-worth (UHNW) wealth management often operates behind a discreet veil, a handful of seasoned professionals and thought leaders have stepped forward to share hard-won insights about managing significant wealth.

Their perspectives reveal that private wealth management is broader than ‘mere’ portfolio construction. It’s about stewarding human, social, and intellectual capital across generations, amid increasingly complex global realities.

James E. “Jay” Hughes Jr., perhaps the most philosophically influential voice in the field, urges advisors to redefine wealth itself. In his seminal work, Family Wealth: Keeping It in the Family, Hughes argues that financial capital is merely one component of true wealth.

He champions the idea that families must cultivate shared values, purpose, and communication to avoid the all-too-common fate of “shirtsleeves to shirtsleeves in three generations.” For Hughes, private wealth management is as much about family governance and emotional resilience as it is about managing money.

Sara Hamilton, founder of the Family Office Exchange (FOX), echoes this broader perspective. She frequently emphasizes that the modern family office has evolved into a private enterprise unto itself -often managing not only investments and taxes but also education, family dynamics, and philanthropy. Hamilton’s research reveals that UHNW families increasingly demand sophisticated reporting tools, technology-driven solutions, and professional management teams, reflecting a shift from informal “family business” models toward highly institutional structures.

From a more technical vantage, Stuart E. Lucas, author of Wealth: Grow It and Protect It, insists that wealthy families should manage their fortunes with the discipline of institutional investors.

Lucas advocates rigorous cost control, transparent governance, and alignment of interests among family members and advisors. His frameworks underscore that UHNW wealth is vulnerable not merely to market volatility, but to hidden costs, complexity creep, and poor strategic discipline >> pitfalls as dangerous as any bear market.

Meanwhile, Charles Lowenhaupt, author of Freedom From Wealth, introduces a counterpoint to the relentless drive for asset growth. He argues that the purpose of wealth should be to serve the life the individual desires… not the other way around.

For Lowenhaupt, the true art of private wealth management lies in helping clients articulate what a “good life” looks like for them and constructing financial strategies that support that vision. His message is a poignant reminder that in UHNW advising, success is measured not only in returns, but in peace of mind and personal freedom.

Together, these voices challenge professionals to elevate their approach beyond financial engineering. They remind us that working with the ultra-wealthy is a deeply human enterprise, demanding both technical mastery and the wisdom to navigate the intangible forces of family, identity, and purpose.

Their insights provide a compass for practitioners seeking to thrive in this complex and fascinating domain.

Private Wealth in Finance Careers

Technical mastery in private wealth isn’t optional—it’s a competitive edge across multiple roles:

~ Private Bankers and Relationship Managers – Trusted advisors who must integrate investments, lending, philanthropy, and complex family dynamics.

~ Portfolio Managers – Experts crafting bespoke portfolios that balance tax efficiency, estate planning, and alternative asset strategies.

~ Trust and Estate Specialists – Architects of family office structures, trusts, and succession plans, often acting as de facto family governance advisors.

~ Investment Consultants – Professionals guiding family offices or foundations, where client goals often defy standard institutional benchmarks.

Mastery of these skills signals your readiness to engage with clients whose wealth (and emotional volatility) can alter the course of entire financial institutions.

How to Talk Private Wealth in Interviews

When interviewing for private wealth or asset management roles, superficial knowledge won’t cut it. You should be prepared to discuss:

- How wealthy clients prioritize wealth preservation over pure alpha—and why.

- The interplay between cross-border tax rules and portfolio design.

- Emotional biases that derail rational investment decisions.

- The mechanics of donor-advised funds, private foundations, and other philanthropic vehicles.

- Case studies demonstrating real-world complexity, not just theory.

Drop references to recent headlines…

a tax scandal involving a celebrity, or a high-profile philanthropic pledge…

and you instantly signal domain expertise.

Why Private Wealth Is One of Finance’s Pinnacle Careers

Private wealth management offers:

- Intellectual Complexity: No two clients, or problems, are ever the same.

- Exceptional Earnings Potential: UHNW clients mean large fees and lucrative compensation for skilled professionals.

- Deep Human Connection: Few finance careers deliver as much personal trust and enduring relationships.

- Global Scope: Wealth is mobile; advisors increasingly navigate cross-border solutions across New York, Singapore, Zurich, and Dubai.

For CFA Charterholders, private wealth represents the perfect intersection of technical mastery and the human dimension of finance…

a realm where you’re as much a strategist as a confidant.

Controversies and Debates in Private Wealth

“The Rich Get Richer” Dilemma

Private wealth management often sits in the crosshairs of public debate over inequality. Advisors sometimes walk a moral tightrope, balancing perfectly legal strategies for tax optimization against broader ethical concerns and reputational risks. The CFA Code of Ethics looms large here. Serving the client’s interest must coexist with a duty to uphold integrity and public trust.

ESG Investing vs. Fiduciary Duty

Many UHNW clients demand ESG portfolios aligned with personal values. Yet advisors must reconcile these preferences with fiduciary duties and evolving regulatory frameworks. As ESG data grows more complex (and regulators crack down on greenwashing) advisors face mounting pressure to balance ethics with performance.

Succession and Family Conflict

The adage “shirtsleeves to shirtsleeves in three generations” exists for a reason. Intra-family rivalries, divergent values, and lack of governance can obliterate fortunes. Private wealth advisors increasingly act as family mediators, crafting governance systems to preserve both assets and relationships.

Further Reading and Resources | Deepening Your Expertise

Ultra-high-net-worth private wealth management is a field where learning never stops.

It’s not enough to master asset allocation models or tax codes.

You’ll also need to stay current with evolving regulations, behavioral finance insights, and the shifting geopolitical forces that shape global wealth.

Below are some exceptional resources that blend technical depth, practical insight, and perspectives from top practitioners.

Books Worth a Permanent Spot on Your Shelf

Family Wealth—Keeping It in the Family – James E. Hughes Jr.

A foundational text exploring the human side of wealth, governance structures, and how families can avoid the “shirtsleeves to shirtsleeves” trap. Essential reading for understanding the emotional and social dimensions of wealth preservation.

Wealth: Grow It and Protect It – Stuart E. Lucas

A practical guide blending institutional investment discipline with private wealth realities. Lucas emphasizes cost control, clear governance, and how families should think strategically about wealth as an enterprise.

The Wise Inheritor – Ann Perry

Focuses on educating heirs and beneficiaries about their rights, responsibilities, and the emotional impact of wealth. Excellent for understanding next-gen wealth transfer dynamics.

Freedom From Wealth – Charles A. Lowenhaupt

A provocative look at how wealth should serve life’s purpose rather than become a burden. Challenges traditional notions of wealth accumulation and offers insights for helping clients define a “good life.”

Complete Family Office Handbook – Kirby Rosplock

A thorough guide for practitioners and UHNW families building or operating family offices, covering investment structures, governance, reporting, and operational best practices.

Podcasts That Sharpen Your Perspective

Capital Allocators – Hosted by Ted Seides, this podcast frequently features leading voices from family offices, private banks, and allocators discussing how they approach investment and governance decisions.

WealthTrack with Consuelo Mack – A long-running show featuring interviews with wealth managers, economists, and financial strategists offering practical insights relevant to private investors and UHNW clients.

The Family Office Podcast – Hosted by Angelo Robles, exploring trends, strategies, and interviews with key players in the family office and UHNW ecosystem.

Websites and Professional Networks

STEP (Society of Trust and Estate Practitioners) – The global professional body for advisors specializing in family inheritance and succession planning. Their journal and technical papers are invaluable for keeping up with international developments in trust and estate law.

Family Office Exchange (FOX) – Offers research reports, networking, and practical resources focused on family office operations, governance, and emerging trends in UHNW wealth.

Institute for Private Investors (IPI) – A community for wealthy families and private investors focused on education and peer-to-peer learning, with frequent research publications on issues unique to UHNW individuals.

News and Analysis You Should Follow

Financial Times Wealth Section – Delivers in-depth reporting on global wealth trends, family offices, tax changes, and regulatory developments affecting the ultra-wealthy.

Bloomberg Wealth – Regularly publishes insights into the lives, challenges, and strategies of the world’s wealthiest individuals, with sharp reporting on tax issues, philanthropy, and high-stakes investment moves.

The Wall Street Journal Private Wealth Section – Excellent for tracking regulatory changes, legal disputes, and personal finance trends among affluent individuals.

Citywire Private Wealth – A niche publication covering private bankers, wealth managers, and trends in UHNW investing.

Pro Tip

Great advisors read broadly. Don’t limit yourself to wealth management journals. Insights into psychology, history, geopolitics, and even art markets often prove crucial when advising clients whose fortunes (and identities) span continents and cultures.

A Journey of Complexity [and Meaning]

Private wealth management is not just about basis points or tax alpha. It’s about shepherding clients through some of life’s most consequential crossroads… legacy, purpose, and the fragility of family ties.

So if you’re drawn to a finance career where numbers matter, but human stories matter even more (where your discretion might avert a family implosion or save a client tens of millions) you’re in the right place.

Keep learning.

Stay curious.

And remember… in this business, the most valuable asset you’ll ever manage is trust.