Each year, thousands of CFA candidates play a dangerous game.

They try to outguess the exam.

They study topic weights, scan recent exam trends, and build preparation plans around “high-probability” sections.

They ignore what they don’t like.

They postpone what feels too hard.

They bet their success on being lucky enough to see familiar material on test day.

It’s understandable.

The CFA curriculum is long.

The pressure is high.

The exam is brutal.

But here’s the truth:

The only safe bet is mastering the entire curriculum.

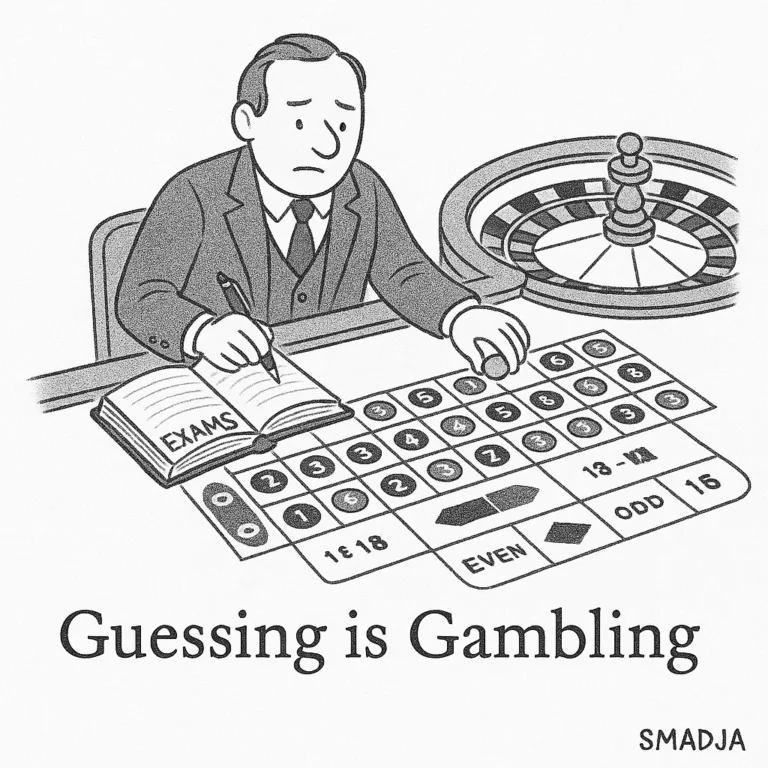

Anything else is a gamble.

The Problem With the Shortcut Mentality

At first, it seems rational to prioritize.

Ethics and FRA are heavily weighted.

Quant and AI might seem less important.

Why not play the odds?

Because the CFA exam isn’t just a test of what you know.

It’s a test of whether you can apply what you know under pressure, across all areas of finance.

You don’t get to choose what shows up.

You don’t get to say, “I skipped this one.”

Every question counts.

And just one blind spot can trigger a chain of missed marks, lost time, and shaken confidence.

The exam isn’t randomized noise.

But it is designed to expose weakness.

And that’s exactly what shortcut strategies create: structural weaknesses that collapse under pressure.

You Can’t Outsmart the Exam. But You Can Outprepare It.

There is no cheat code for the CFA exam.

There is no “most tested topic” that guarantees a pass.

The only way to feel confident walking into that exam room is to know, with complete certainty, that you left no major gaps behind.

That you built full coverage into your process.

That you earned your edge through completeness, not guesswork.

And this doesn’t mean studying everything equally.

It means studying everything strategically—with systems that make the workload manageable, not optional.

The Long Game Always Wins

The CFA charter is not a short-term credential.

It is a long-term investment in your career, your credibility, and your professional identity.

And like all long-term investments, it requires consistency, not speculation.

The candidates who pass are not always the smartest.

They are not always the most confident.

But they are the ones who commit to the process.

They show up.

They master the material—not because they love every topic, but because they refuse to be vulnerable anywhere.

That mindset is rare.

It’s also unstoppable.

Gaps Don’t Stay Isolated—They Compound

One of the biggest misconceptions CFA candidates have is this:

“If I can just get through Level I, I’ll go back and clean things up later.”

That never works.

The CFA Program is not a set of disconnected exams.

It’s a progressive system—each level builds on the one before it.

Concepts introduced in Level I (like time value of money, basic accounting, and ethics) are assumed knowledge in Level II.

By Level III, you’re expected to apply all of it with speed and precision in real-world scenarios.

If you leave gaps in Level I or II, those weak points will come back.

You will feel it when you hit valuation in Level II or when you’re writing structured responses in Level III.

And the time to fix those gaps is not after you’ve passed.

It’s now.

This is why full mastery isn’t about overkill.

It’s about protecting your future self from pain.

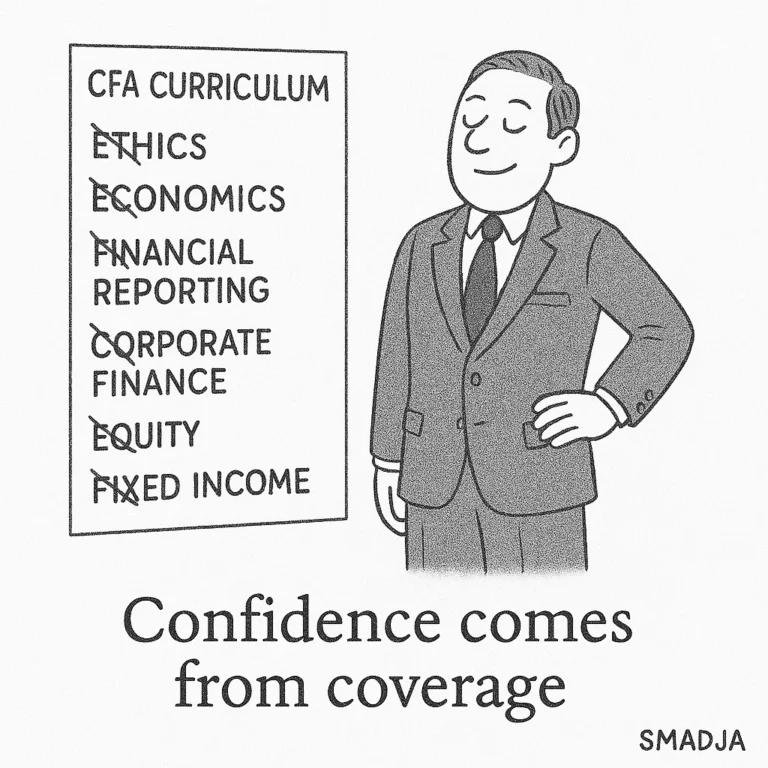

Confidence Comes From Coverage

There’s no better feeling than walking into the exam room knowing you’ve earned the right to be calm.

Not because you’re hoping to get lucky.

Not because you crammed the big topics.

But because you built a real foundation.

When you’ve covered the entire curriculum—topic by topic, formula by formula—you walk in differently.

Your posture changes.

Your breathing slows.

You don’t panic when a curveball shows up because you’ve built the depth to handle it.

That kind of confidence stays with you.

You carry it into interviews.

You carry it into portfolio discussions.

You carry it into the next crisis at work when everyone else is flustered.

Mastery isn’t just about passing the exam.

It’s about becoming the kind of professional who can handle complexity under pressure.

What It Looks Like in Practice

At Charter Doozy, we teach full-curriculum mastery through structure and rhythm:

Study calendars that include every reading

Review loops that systematically revisit weak areas

Mindset training that replaces anxiety with discipline

Recovery systems that help you stay on track even after a missed session

Weekly check-ins to keep pressure consistent and progress measurable

We don’t teach guesswork.

We don’t bet on “important topics.”

We build engines strong enough to carry you across the whole race.

Final Thoughts

There are two types of CFA candidates:

Those who hope the test will meet them where they’re comfortable

And those who train until they’re ready for anything

The first group studies to survive.

The second group studies to win.

If you’re serious about passing the CFA exam—especially on the first attempt—there is only one safe bet:

Master the entire curriculum.

Everything else is noise.