We analyzed dozens of CFA candidate responses — here’s what actually trips people up.

CFA Level II has a reputation – it’s the meat grinder of the program.

The item sets are denser, the questions trickier, and the material less forgiving.

But what are the specific readings or concepts that consistently knock candidates off their game?

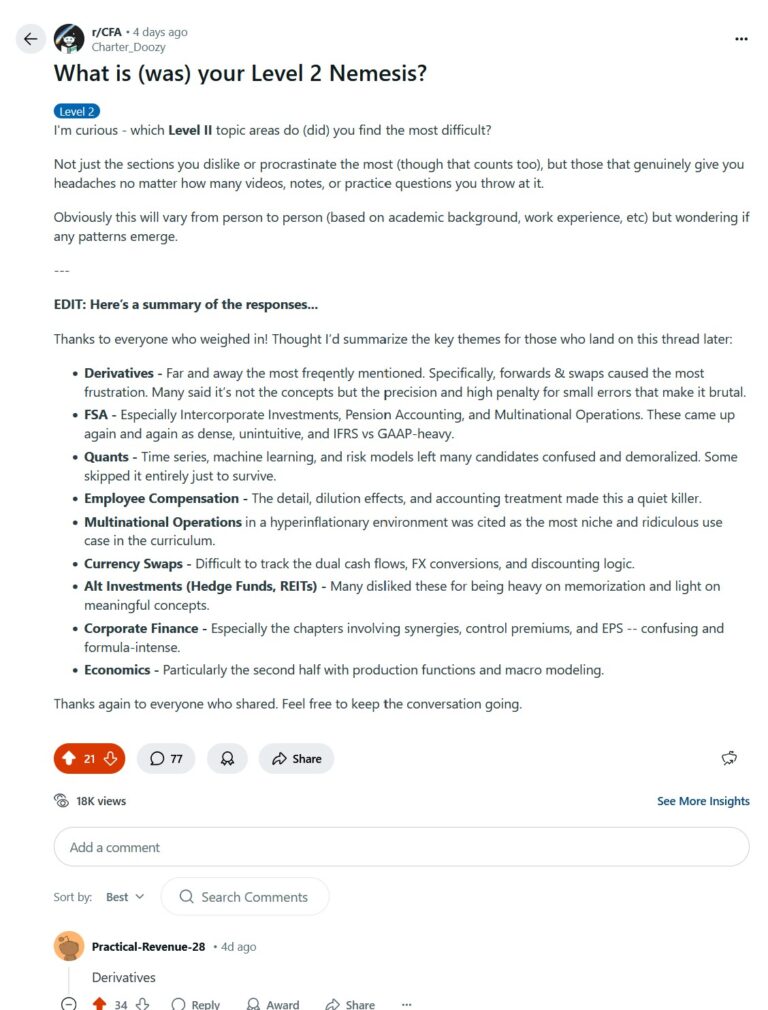

To find out, we asked the r/CFA community: “What was your Level II nemesis?“

The answers poured in from candidates and Charterholders across all backgrounds (over 18,000 views | 77 comments).

While individual struggles vary, several themes emerged loud and clear.

This article breaks down the most commonly cited problem areas, why they’re so tough, and what (if anything) helps tame them.

1. Derivatives: The Relentless Precision Test

By far the most common response. Candidates across the board mentioned Level 2 Derivatives, particularly forwards and swaps, as their biggest pain point.

Why?

It’s not that the concepts are incomprehensible.

In fact, once the replication logic clicks, the underlying mechanics make sense.

The problem is the execution.

Small mistakes — a wrong sign, missed discounting step, or incorrect rate convention — can throw off an entire calculation.

Under time pressure, there’s zero room for error.

What helps:

Custom formula sheets focused only on Derivatives

Visual cash flow diagrams to track inflows/outflows over time

Scenario-based thinking: “who is better off right now?”

2. FSA: The Accounting Gauntlet

Next up?

Financial Statement Analysis — especially the sections on:

Intercorporate Investments

Pension Accounting

Multinational Operations

These sections earned words like “brutal,” “dense,” and “unintuitive.”

For candidates without an accounting background, this section can feel like learning a new language.

Even those who do have that background often trip up on the IFRS vs GAAP differences, which feel arbitrary and rule-heavy.

What helps:

Summary tables comparing IFRS and GAAP treatment

Repetition of practice questions to internalize rules

Study groups to talk through logic and examples

| Component | IFRS | GAAP |

|---|---|---|

| Pension Expense Location | All components split between P&L and OCI | All components may be recognized in P&L, some in OCI |

| Service Cost | Reported in P&L | Reported in P&L |

| Net Interest on Net Pension Liability/Asset | Reported in P&L using discount rate | Reported in P&L using expected return on plan assets |

| Past Service Cost | Reported in P&L immediately | Initially in OCI, then amortized to P&L |

| Actuarial Gains & Losses | Reported in OCI | Initially in OCI, then amortized to P&L |

| Re-measurements | Includes actuarial gains/losses and return on plan assets | Includes actuarial gains/losses and prior service cost |

| Recognition of Re-measurements | Recognized in OCI, not amortized to P&L | Amortized to P&L over time |

| Presentation on Financial Statements | Separate line items in P&L and OCI | May aggregate into single line in P&L |

3. Quant: Stats on Steroids

Quantitative Methods caused a lot of headaches — particularly:

Time series analysis

Machine learning & AI

Risk models

The complaints weren’t just about difficulty, but tone.

Many said it felt like these readings were lifted from a data science textbook and dropped into the CFA curriculum with minimal effort to tie them into the rest of the program.

What helps:

Focus on understanding the logic (don’t just memorize)

Build a “cheat sheet” for each model or distribution

Accept that a few buzzwords might need to be memorized blindly

4. Employee Compensation & Dilution

One of the “silent killers” of CFA Level II.

RSUs, options, vesting schedules, and fair value calculations combine into a reading that’s detail-heavy and test-unfriendly.

Why it hurts:

Every detail matters

Lots of room for confusion (e.g. is this pre- or post-dilution?)

Often mixed into other FSA-style questions, making it harder to isolate

What helps:

Diagramming the dilution process

Practice and revision (a lot).

5. Multinational Operations & Currency Swaps

When FX meets accounting or derivatives, chaos often follows.

Candidates cited these as nightmare scenarios due to:

Multiple currencies

Multiple interest rates

Tricky discounting logic

Hyperinflationary environments in particular were seen as overly niche but still fair game on exam day.

What helps:

Use timelines to track currency and cash flows

Flag and review FX-related assumptions carefully

6. Rote Memorization Overload: Alts, REITs, Hedge Funds

These readings weren’t called out for their complexity, but for how uninspired they felt.

Candidates described them as a list of classifications to memorize without much analytical value.

What helps:

Accepting they’re low-yield and moving on quickly (?)

| Alternative Investment Type | Liquidity | Typical Investor Profile | Return Profile | Risk Profile | Typical Fees |

|---|---|---|---|---|---|

| Hedge Funds | Low to Medium | Accredited / Institutional | Absolute Return / Alpha-Seeking | High (Strategy Dependent) | 2% + 20% |

| Private Equity | Low | Institutional / HNW | High Return Potential | High | 2% + 20% |

| Real Estate | Low to Medium | Retail / Institutional | Stable / Income-Oriented | Moderate | 1% - 2% |

| Commodities | High | Retail / Institutional | Speculative / Cyclical | High | Low (Commissions / ETF Fees) |

| Infrastructure | Low | Institutional | Stable / Long-Term | Moderate to High | 1% - 2% |

| REITs | High (if publicly traded) | Retail | Income + Capital Appreciation | Moderate | Management Fees Only |

| Venture Capital | Very Low | Institutional / HNW | High Risk / High Return | Very High | 2% + 20% |

| Distressed Debt | Low | Institutional / HNW | Opportunistic / Event-Driven | High | 2% + Incentive Fees |

7. Corporate Finance: M&A Mayhem

The back end of Corporate Finance (Mergers, Acquisitions, Divestitures) is where many candidates said the wheels came off.

The logic around control premiums, synergies, and accretion/dilution was cited as being both formula-heavy and conceptually murky.

What helps:

Clear frameworks for post-merger valuation

EPS impact templates

8. Economics: The Academic Abyss

Topics like production functions, total factor productivity, and Cobb-Douglas equations earned collective eye-rolls.

These readings were often described as abstract, dry, and difficult to apply under pressure.

What helps:

Focus on big-picture conceptual links (growth theory, capital deepening)

Don’t overinvest in obscure calculations

Final Thoughts

What trips up CFA Level II candidates isn’t always what you expect.

Some topics look simple on the surface but are packed with traps.

Others feel out of place or oddly worded.

And some are just… boring.

But knowing where others struggle can be a competitive advantage.

When you’re building your study plan, anticipate the pain points and budget accordingly.

And remember.. you’re not alone.

These are some of the sharpest candidates out there, and they’re struggling too.

Need a Plan That Works?

At Charter Doozy, we help CFA candidates build customized study strategies that account for your background, strengths, and weak spots.

If you’re feeling overwhelmed or stuck, book a free strategy call or check out our coaching programs.

Let’s make sure you master L2!