⭐ Irving Kahn – Quick Facts

A Century in the Market

In 2012, a reporter asked a 106-year-old Irving Kahn whether he thought the market was overvalued. Without missing a beat, Kahn replied, “I can’t tell you how the market will do this week or next, but I can tell you that buying cheap stocks works, if you don’t get scared out of them.” At an age when most men have long since exited the stage, Kahn was still reading annual reports, sending trade tickets to his brokers, and practicing the discipline he’d honed over more than 80 years in the markets.

Irving Kahn was not merely a veteran investor. He was an eyewitness to the 1929 crash, a colleague of Benjamin Graham, and the co-founder of Kahn Brothers, a value-oriented investment firm that continues to operate today. Kahn’s investing life spanned the Roaring Twenties, the Great Depression, two world wars, the post-war boom, the oil shocks of the 1970s, the dot-com bubble, and the Global Financial Crisis—and he remained unwaveringly committed to value investing through it all. His career serves as a bridge connecting the earliest days of modern security analysis to today’s complex markets.

Want to think like the world’s best investors?

Dive into the mindsets, philosophies, and powerful quotes from legends like Soros, Fisher, Dalio, and more. Learn timeless strategies that turn insight into wealth – and transform how you see the markets.

The Dean of Longevity and Value

Irving Kahn was born in New York City in 1905, the eldest of four siblings in a Jewish family of modest means. His fascination with business began as a teenager delivering copies of The Wall Street Journal. After graduating from City College of New York, Kahn landed a job as a clerk at a brokerage firm. His life changed forever when he enrolled in Benjamin Graham’s legendary classes at Columbia University in the 1930s. Kahn quickly became Graham’s teaching assistant and research analyst, working on revisions of Graham’s classic Security Analysis.

Kahn’s investment style was pure value investing in the Graham mold. He searched for companies selling at significant discounts to intrinsic value, anchored by rigorous analysis of balance sheets, income statements, and assets. He developed a reputation as one of the most steadfast practitioners of the Graham school—a man who believed that numbers and discipline could protect investors from the emotional turbulence of markets.

By the time he co-founded Kahn Brothers in 1978, Irving Kahn had already logged half a century in the markets. He would go on investing until well past his 100th birthday, earning him the informal title of “the world’s oldest active investment professional.”

Irving Kahn’s Core Philosophy: Value, Patience, and Prudence

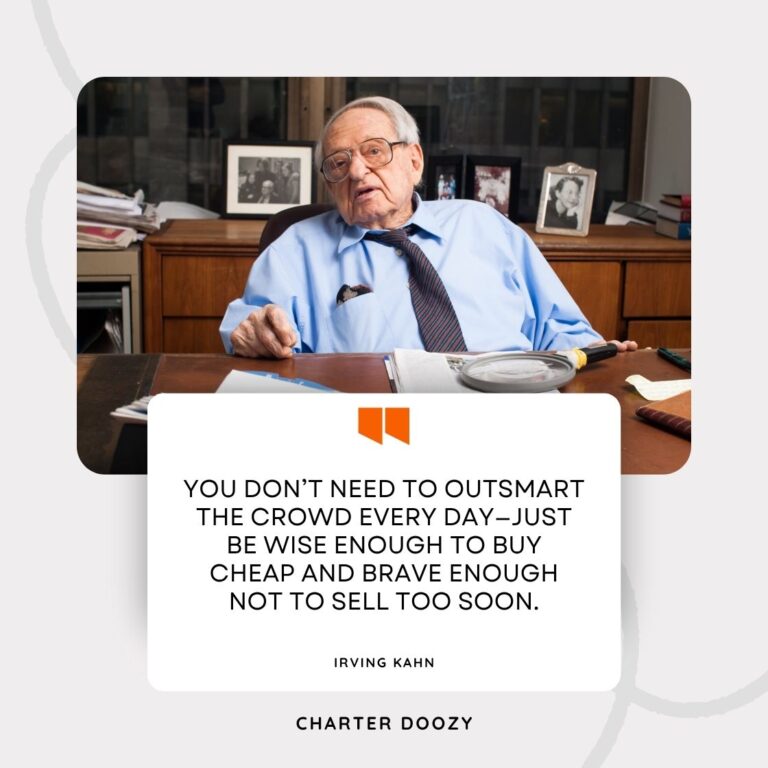

Kahn’s investing philosophy was grounded in the classic principles of Benjamin Graham but personalized through decades of experience. He believed that investing success did not come from predicting markets or trends but from buying stocks when they were cheap relative to intrinsic worth and holding them patiently.

Kahn described the market as “a casino without the glass walls,” where most participants are driven by speculation rather than analysis. His goal was to step outside that chaos, focusing on a few simple but powerful tenets.

First, price mattered above all. Like Graham, Kahn viewed every security as a claim on underlying assets and earnings. He sought stocks trading at significant discounts to book value or net current asset value, providing what Graham famously called a “margin of safety.”

Second, Kahn emphasized conservative balance sheets. He avoided companies burdened with excessive debt, especially in cyclical industries where a downturn could wipe out equity holders.

Third, he believed in fundamental research over management meetings or macro forecasting. Kahn seldom relied on conversations with CEOs or CFOs, insisting that financial statements and filings told a more honest story than corporate presentations.

Fourth, he practiced patience bordering on stubbornness. Kahn once said, “Patience is the key to success in investing. You have to be willing to wait.” He routinely held stocks for years while waiting for value to be recognized by the market.

Finally, he recognized that mistakes were inevitable. His antidote was diversification and discipline rather than conviction-based concentration. Though he maintained relatively focused portfolios at Kahn Brothers, he avoided oversized bets that could jeopardize client capital.

These principles aligned perfectly with key topics in the CFA curriculum, particularly Equity Valuation, Financial Statement Analysis, and Portfolio Management. Kahn’s method was an embodiment of bottom-up, fundamental research designed to uncover mispriced securities.

Stories from an Eight-Decade Career

One of the most striking examples of Kahn’s discipline came in 1929. As a young analyst, he shorted stocks ahead of the Great Crash. He reportedly shorted Magma Copper, which had been driven to dizzying heights by rampant speculation. When the market collapsed in October 1929, Kahn’s short bet was vindicated, sparing him the financial ruin that devastated many of his contemporaries. This episode showcased his skepticism toward market exuberance—a quality that would define his entire career.

Decades later, in the 1970s, Kahn Brothers invested in undervalued bank stocks during a period of widespread pessimism over rising interest rates and economic stagnation. Many investors shunned the financial sector, fearing inflation and regulatory changes. But Kahn saw that many banks were trading below book value despite solid balance sheets and conservative lending practices. Over time, as confidence returned to the financial system, those positions generated handsome gains.

In the 1990s and early 2000s, Kahn Brothers built positions in undervalued healthcare and industrial companies trading at single-digit price-to-earnings ratios. Kahn repeatedly emphasized that investors should avoid chasing technology stocks at extreme valuations, notably during the dot-com bubble. When the bubble burst, Kahn Brothers was largely insulated from the carnage because their portfolios remained anchored in tangible value.

One quote encapsulates his approach: “You don’t need to be brilliant, just a little bit wiser than the other guys, on average, for a long, long time.”

These stories connect directly to topics like Behavioral Finance (herding and speculative bubbles), Financial Statement Analysis (identifying robust balance sheets), and Equity Valuation (discounts to intrinsic value). For CFA candidates, Kahn’s career is a living demonstration of how core analytical skills and disciplined processes can protect against market excesses.

Lessons for CFA Candidates and Investment Professionals

Irving Kahn’s career offers powerful lessons for anyone pursuing the CFA charter or working in investment management.

First, the CFA curriculum drills into candidates the importance of rigorous analysis over speculation. Kahn’s entire philosophy embodied this principle. Whether calculating net current asset value or evaluating debt ratios, he was relentless in seeking facts over forecasts.

Second, Kahn’s life proves the power of patience and contrarian thinking. In a profession prone to short-termism, he stood as an example of how time arbitrage—willingness to hold unpopular positions until fundamentals prevail—can be a lasting competitive edge.

Third, Kahn exemplified risk management. His focus on solid balance sheets, conservative valuations, and diversification aligns directly with Portfolio Management topics in the CFA Program. He understood that capital preservation is as crucial as capital growth.

Fourth, Kahn’s career is a reminder that simple strategies, applied consistently, can outperform. Many CFA candidates get caught up in complex quantitative models. While such tools are valuable, Kahn’s success shows that clarity and discipline in applying fundamental principles often trump complexity.

Finally, Kahn’s humility and lifelong learning should inspire candidates. He worked well into his centenarian years, always curious, always studying new opportunities. In an industry often marked by ego, his longevity and steady returns were the ultimate testament to quiet professionalism.

Debates and Modern Challenges

While Kahn’s approach delivered strong returns for decades, some critics argue that pure value investing has struggled in the 21st century. The rise of intangible assets, technology platforms, and network effects means that many successful modern businesses have low physical assets yet high valuations based on brand, intellectual property, and market share. Metrics like price-to-book can miss the value of such intangibles, leading value investors to underweight dominant companies like Amazon or Alphabet during periods of extraordinary growth.

Moreover, critics argue that market efficiency has increased, compressing the opportunities for deep-value investing. Quantitative screens and algorithmic trading have made traditional value signals more crowded trades, reducing alpha potential.

Still, Kahn would likely reply that markets remain human enterprises, prone to emotion and error, and that true bargains still exist for patient investors willing to dig beneath the surface.

Further Reading and Resources

For those wishing to explore Irving Kahn’s philosophy in more depth, several resources are invaluable:

- Security Analysis by Benjamin Graham and David Dodd, to which Kahn contributed during his tenure with Graham.

- “The Superinvestors of Graham-and-Doddsville” Warren Buffett’s famous 1984 essay profiling Kahn and other Graham disciples.

- The Intelligent Investor by Benjamin Graham, foundational reading for understanding Kahn’s framework.

A Final Word of Encouragement

Irving Kahn lived through more market cycles than most investors can study in a lifetime. His career was a monument to discipline, humiliAty, and the power of independent thinking. He proved that you don’t need to predict markets or chase trends to succeed in investing. Instead, careful analysis, patience, and a steady temperament can compound into extraordinary results over time.

As you progress through the CFA journey, remember Irving Kahn’s enduring lesson: investing is ultimately about common sense, curiosity, and the courage to act when others hesitate. Keep learning, keep questioning, and never lose sight of the timeless principles that guide successful investors through both calm seas and storms. That, more than any single trade or trend, is the true legacy of the great investors who came before us.