When candidates first encounter Quantitative Methods in the CFA Program, many assume it’s just a math-heavy hurdle to clear.

Formulas. Spreadsheets. Valuation models.

Everything in its place. Everything either right or wrong.

But great analysts (the ones who rise above rote memorization and mechanical analysis) don’t live in black and white.

They live in the grey.

The Myth of the “Math Mind”

There’s a common assumption that great analysts are defined by mathematical fluency.

And yes, you need to be comfortable with numbers.

Yes, you need to model, forecast, quantify.

But raw math skills don’t make a great analyst any more than knowing grammar makes a great writer.

It’s not about calculation. It’s about calibration.

Statistics vs. Mathematics

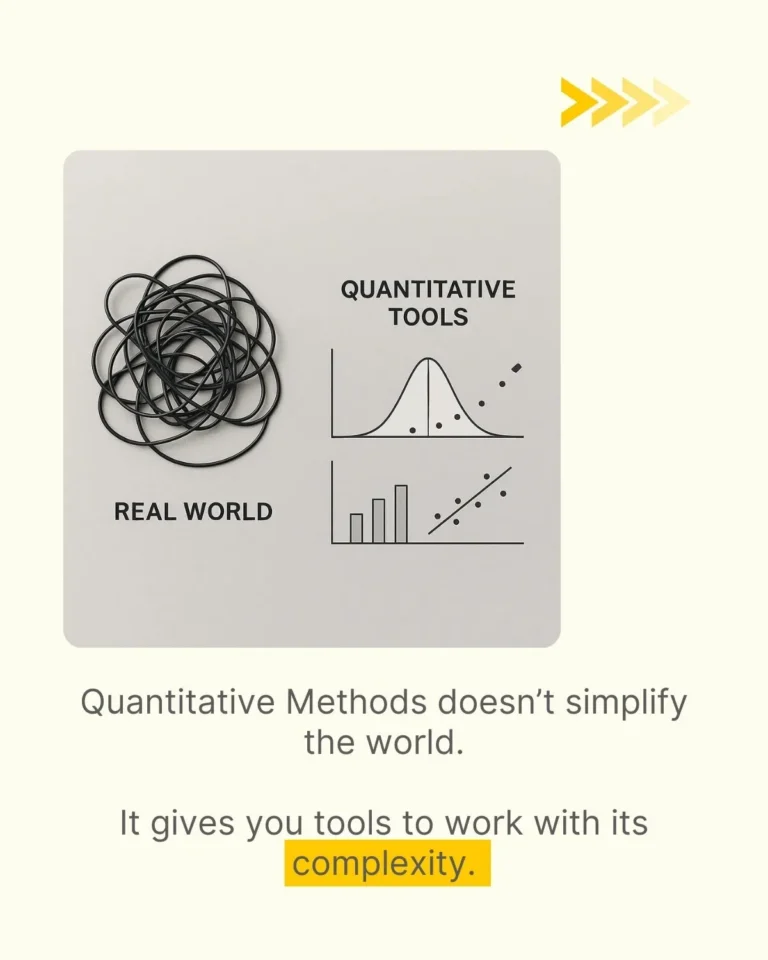

Outsiders see CFA Quantitative Methods and assume it’s all math.

But Quant isn’t pure mathematics. It’s actually statistics.

And that distinction matters.

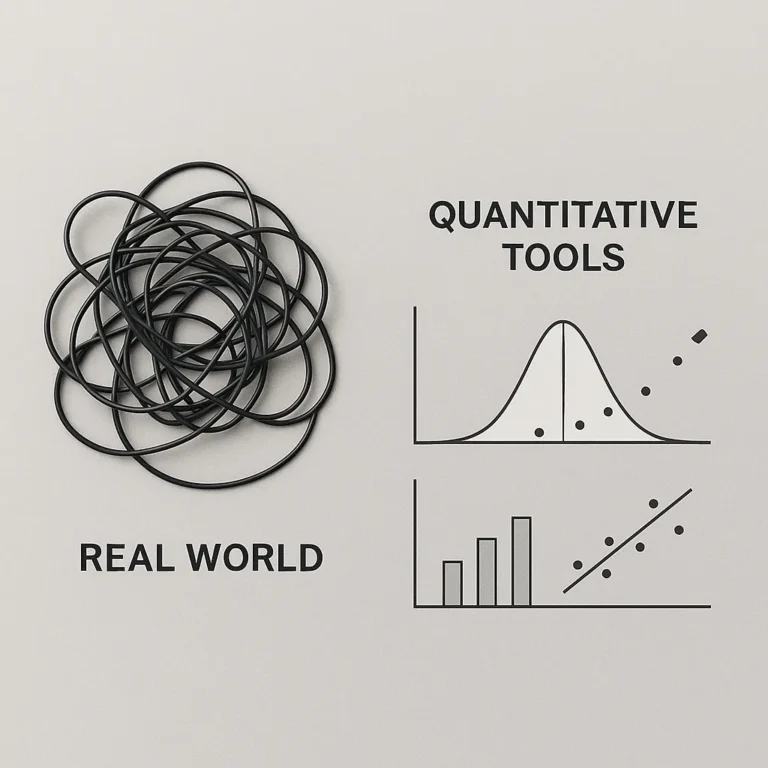

Mathematics is deterministic… Clean. Logical. Elegant.

Statistics is stochastic…. Probabilistic. Full of unknowns. Able to handle the messy reality.

Where math asks for proof, statistics asks for confidence.

Math deals in certainty (think x + y = z).

Statistics deals in likelihoods (think x + y = z at 95% confidence).

And when you’re working in markets (driven by humans, narratives, incentives, surprises, and feedback loops) you don’t get certainty.

You get distributions.

Real-World Finance Isn’t Binary

Great analysts know this.

They aren’t looking for one “right answer.” They’re evaluating the range of outcomes.

They don’t anchor on a single scenario.

They weigh probabilities.

They factor in uncertainty.

They allow for irrationality, bias, and regime change.

They know that:

A good decision can lead to a bad outcome.

A bad process can lead to lucky wins.

And even the best forecast is still a guess.

Ready to Stop Guessing?

Subscribe to Doozy Digest — Free Daily CFA Insights That Hit Different.

No spam. Ever. Cancel any time.

The Blend That Matters

That’s why Quant Methods matters.

Not because it teaches you math.

But because it trains you to think systematically in an uncertain world.

It sharpens your ability to:

Distinguish signal from noise.

Apply logical frameworks to emotional markets.

Create structure in chaos.

It forces you to hold two truths at once:

Use rigorous thinking.

But never trust any single model blindly.

Analysts as Pattern Interpreters, Not Rule Followers

As you work through CFA Level 1 and Level 2 Quantitative Methods, remember that ultimately you’re here to learn a set of skills and tools and way of thinking.

When you finally get your Charter (🙏), it’s likely that you will forget many of the formulas and details covered in CFA Quants (unless you work in a technical data crunching role).

But the way of thinking should never leave you.

You’re here to become the kind of thinker who can navigate ambiguity without losing the plot.

Who can see beyond the obvious.

Who knows that statistics isn’t about finding the right answer – it’s about asking better questions.

Final Thoughts

What separates average analysts from great ones isn’t who can do long division in their head.

It’s who can dance between structure and softness.

Who can model the world without pretending to control it.

Who respects the numbers without being ruled by them.

Quantitative Methods is your training ground for that mindset.

It teaches you how to reason like a professional – and think like an investor.

Not in black and white. But in gradients.

In nuance.

In possibility.