Imagine standing on the edge of a cliff, blindfolded, about to jump…

and someone says…

“Relax! We ran the computer simulation a million times. The trampoline at the bottom will catch you, with 99.5% confidence.”

Would you trust them?

Welcome to the world of financial simulations.

It’s an area where we try to predict the future, reduce risk… and sometimes fall spectacularly short.

Simulations in the CFA Curriculum. Why You Should Care

If you’re grinding through the CFA studies – or starting a career in finance – you’ll meet simulations early and often.

Level I introduces Monte Carlo simulation under Quantitative Methods, which is used in derivative pricing, Value at Risk (VaR) calculations and portfolio stress testing.

Level II levels up with Machine Learning and Big Data. Suddenly, simulations blend with AI for bootstrapping regressions, Monte Carlo for financial time series, and ML-driven scenario generation.

Simulations matter because finance and the future are never certain.

But, as my CFA mentor liked to say: “The map is not the terrain.”

Especially models that spit out a single answer feel safe. But reality doesn’t work that way.

The trick to mastering stochastic (statistical) modelling is to understand the concept of many possible futures… not just one.

If this is new to you, then strap yourself in as we go down the rabbit-hole.

Monte Carlo – The Classic Workhorse

Let’s start with the old-school hero: Monte Carlo simulation.

Born during the Manhattan Project (yes, nuclear bombs and finance have shared roots), Monte Carlo takes your model and feeds it randomness.

Random numbers + Your model = Thousands of “what if” scenarios

Use Case #1 – Option Pricing

Imagine pricing an Asian option (where the payoff depends on the average price of the underlying asset).

There’s no simple Black-Scholes formula.

So you simulate (hundreds of) thousands of price paths, average the payoffs, and discount them to today.

Use Case #2 – VaR

Banks run Monte Carlo simulations to measure potential trading losses.

Rather than assuming normal returns, they simulate correlated market shocks across assets.

Monte Carlo’s Superpowers

~ Handles complex payoffs and non-linear risks

~ Models path dependency

~ Excellent for stress testing

But beware!!

~ Computationally intense (Simulating a million paths isn’t cheap)

~ Sensitive to assumptions (Garbage in = garbage out)

~ Hard to explain. (Telling a client, “We simulated 500,000 paths,” can sound like techno-babble)

Enter Machine Learning

Fast forward from the 1940s to today and we have… Machine Learning (ML) powered simulations.

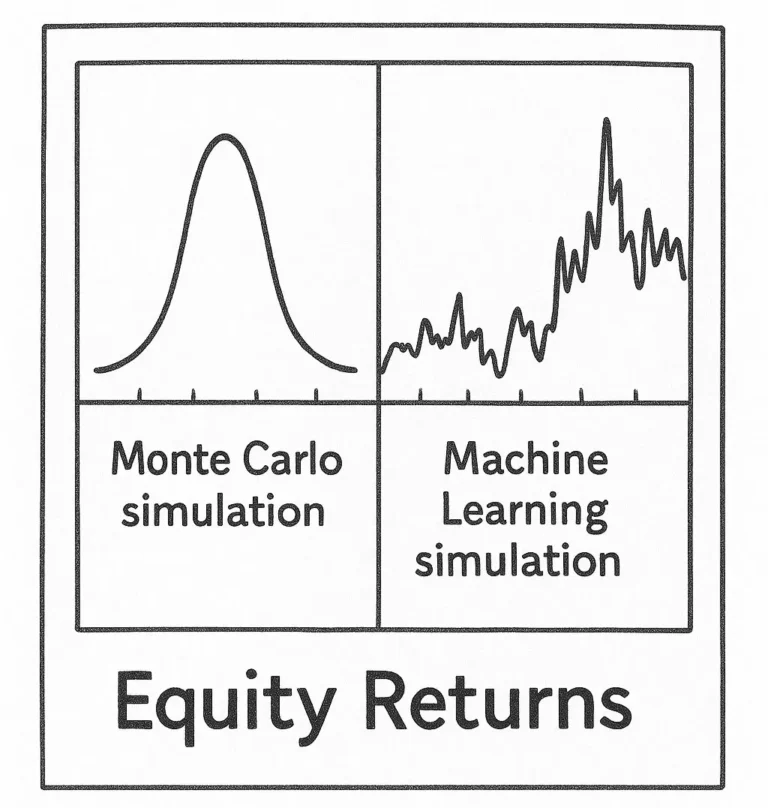

Monte Carlo generates randomness from known statistical distributions.

Machine learning takes a different route… it makes no a priori assumptions, but studies the data to generate synthetic outcomes that look like the real thing.

This matters in finance where

- Market behavior is non-linear

- Crises don’t follow normal patterns

- You want to model rare events (fat tails)

Use Case #1 – Asset Allocation

Traditional Monte Carlo might simulate equity returns as normal distributions. But markets show fat tails and volatility clustering.

So quants train ML models (like GANs – Generative Adversarial Networks) on decades of stock data to generate synthetic crises.

These scenarios help build robust portfolios that can survive realistic extreme events.

Use Case #2 – Trading Strategy Testing

Quant funds test trading models over simulated data to spot strategies that look great historically but collapse in new conditions.

ML-generated synthetic data helps reveal overfitting.

Where Simulations Shine, and Where They Suck

When They’re Awesome

Exploring uncertainty when closed-form math fails

Stress testing complex portfolios

Pricing exotic derivatives

Avoiding overfitting by testing models on synthetic data

When They Suck

False precision (8 decimal places ≠ truth)

Dependence on assumptions

ML simulations can simply memorize noise

Heavy computational demands

Remember Long-Term Capital Management? Their models assumed market movements would stay within historical norms. Then Russia defaulted in 1998, correlations spiked, and a ‘once-in-a-million-year-event simulations’ didn’t save them.

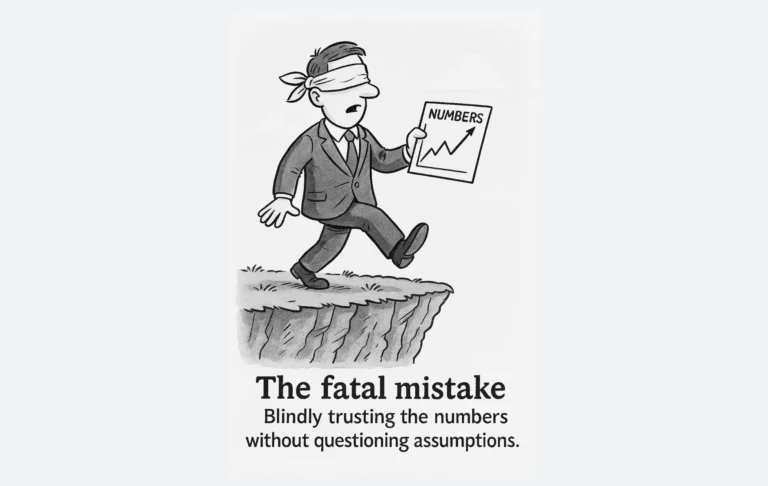

Simulations don’t predict the future. They create possible futures, if your assumptions hold.

Simulations in Finance Jobs

So where does all this show up in real finance jobs?

Asset Management – Portfolio construction under different scenarios. Stress testing against historical or synthetic crises

Trading – Exotic derivatives pricing using Monte Carlo. Quant trading strategy testing with ML simulations

Wealth Management – Financial planning tools simulating retirement outcomes… for example “There’s a 10% chance your retirement portfolio falls below $800,000. Let’s adjust your plan.”

Corporate Finance – Project finance simulations to test NPV under fluctuating commodity prices, interest rates, etc.

Simulations in the News

Simulations regularly make headlines.

Remember COVID-19 stress testing? Banks simulated pandemic impacts on credit losses.

Climate risk scenarios. Regulators push banks to simulate future climate risks.

Flash crash prevention. Regulators worry about ML-driven funds creating ‘flash crashes’. Many funds now test algorithms under thousands of simulated conditions.

CFA Exam Tips – Mastering Simulations

If you’re prepping for CFA exams, keep these pointers in mind…

Understand the purpose of what you’re studying (the ‘why’, and not only the ‘what’ or ‘how’) . Monte Carlo = a tool to model uncertainty, not magic.

Know key inputs. Volatility, correlations, random number generation.

Interpret simulation outputs. Know how to explain confidence intervals and probabilities.

Connect simulations to risk management. They’re intertwined with VaR, stress testing, and scenario analysis.

The fatal mistake – Blindly trusting the numbers without questioning assumptions.

Take it Further

Curious to go deeper? Check these out…

Books

- Building Winning Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Trading – Kevin J. Davey.

- Advances in Financial Machine Learning — Marcos López de Prado.

Paper

- The Role of Generative Adversarial Networks (GANs) in Market Simulation – Joel Paul (Stanford University)

Website

- Kaggle – competitions for ML simulation practice

Podcast

The Big Takeaway

Your job in finance is to navigate uncertainty, spot hidden risks, and avoid being blindsided by the unexpected.

Simulations remind us: no single future exists.

A useful mantra to consider while working through your CFA exam studies is..

“All models are wrong. Some are useful. Simulations can help you figure out which is which.”

Keep questioning assumptions. Keep learning.

… And may every simulated cliff you face have a trampoline beneath it.