The Crucial Role of Quantitative Methods in CFA Level 2

Quantitative Methods in the CFA Level 2 exam form the backbone of financial analysis and decision-making.

These methods are not merely academic exercises (and a headache).

They are powerful tools that professionals use daily to navigate the complexities of the financial markets.

As you embark on your CFA Level 2 journey, understanding the significance of these methods is essential to unlocking success.

The CFA Level 2 exam builds upon the foundations laid in Level 1, diving deeper into the applications of quantitative techniques in areas such as equity valuation, portfolio management, and risk assessment.

The exam tests your ability to apply statistical and mathematical models to real-world scenarios, making Quantitative Methods a critical component of your study plan.

Breaking Down the Core Curriculum

Statistical Inference and Hypothesis Testing

Statistical inference is at the heart of making data-driven decisions. In the context of CFA Level 2, you’ll be required to draw conclusions about populations based on sample data.

This section covers essential concepts such as confidence intervals, p-values, and hypothesis testing.

These are tools that allow you to evaluate investment opportunities and risks with statistical rigor.

Imagine you’re tasked with assessing the performance of a new investment strategy.

Statistical inference enables you to determine whether the observed results are statistically significant or merely due to random chance.

This ability to differentiate between genuine performance and noise is a skill that can set you apart as a financial analyst.

Application in Real-World Scenarios

Consider a scenario where you’re analyzing the performance of two mutual funds.

Hypothesis testing allows you to determine whether the difference in their returns is statistically significant or if it could have occurred by chance.

This is a vital skill when advising clients or making investment decisions, as it ensures that your recommendations are based on sound statistical evidence.

Time Series Analysis – Predicting the Future with Confidence

Time series analysis is a powerful tool for predicting future values based on past data.

In CFA Level 2, you’ll delve into autoregressive models, moving averages, and exponential smoothing techniques.

These models are used to forecast economic indicators, stock prices, and other financial metrics.

The ability to analyze and predict trends over time is invaluable in finance.

Whether you’re forecasting market movements or assessing the potential impact of economic events, time series analysis equips you with the tools to make informed decisions.

Historical Anecdote – The Great Depression

Time series analysis has been used historically to predict economic downturns.

For instance, in the lead-up to the Great Depression, some economists who analyzed time series data warned of an impending collapse.

While their warnings were not heeded, the accuracy of their predictions underscores the importance of mastering these techniques.

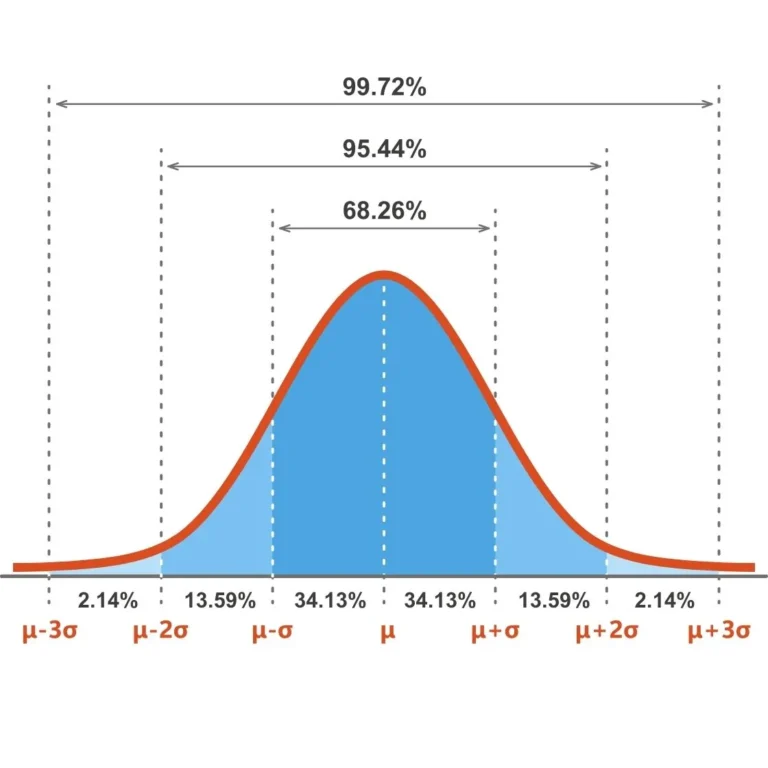

Probability Distributions – Understanding Uncertainty

Probability distributions are the building blocks of risk management.

In CFA Level 2, you’ll encounter various types of distributions, including normal, binomial, and Poisson distributions.

These concepts are essential for modeling the uncertainty inherent in financial markets.

Understanding probability distributions allows you to evaluate the likelihood of different outcomes, which is crucial when assessing the risk-return tradeoff of an investment.

Whether you’re calculating the value-at-risk (VaR) of a portfolio or estimating the probability of default on a bond, these methods are indispensable.

Practical Example: Portfolio Management

In portfolio management, probability distributions help you assess the likelihood of achieving a target return.

By understanding the distribution of possible returns, you can better gauge the risks associated with different investment strategies and make more informed decisions.

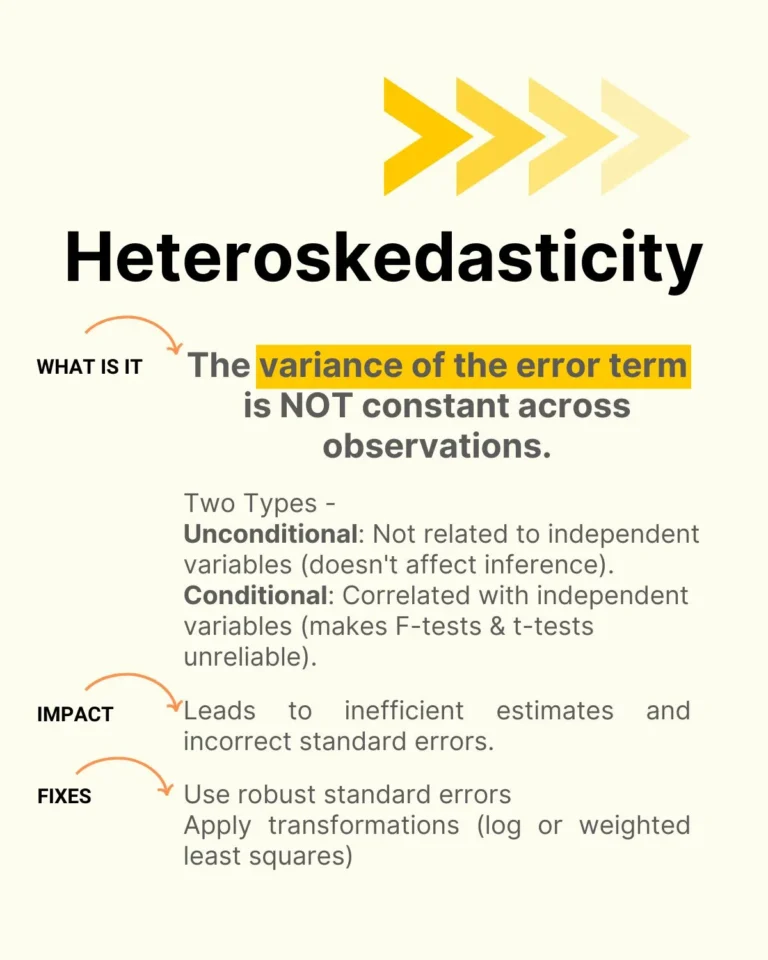

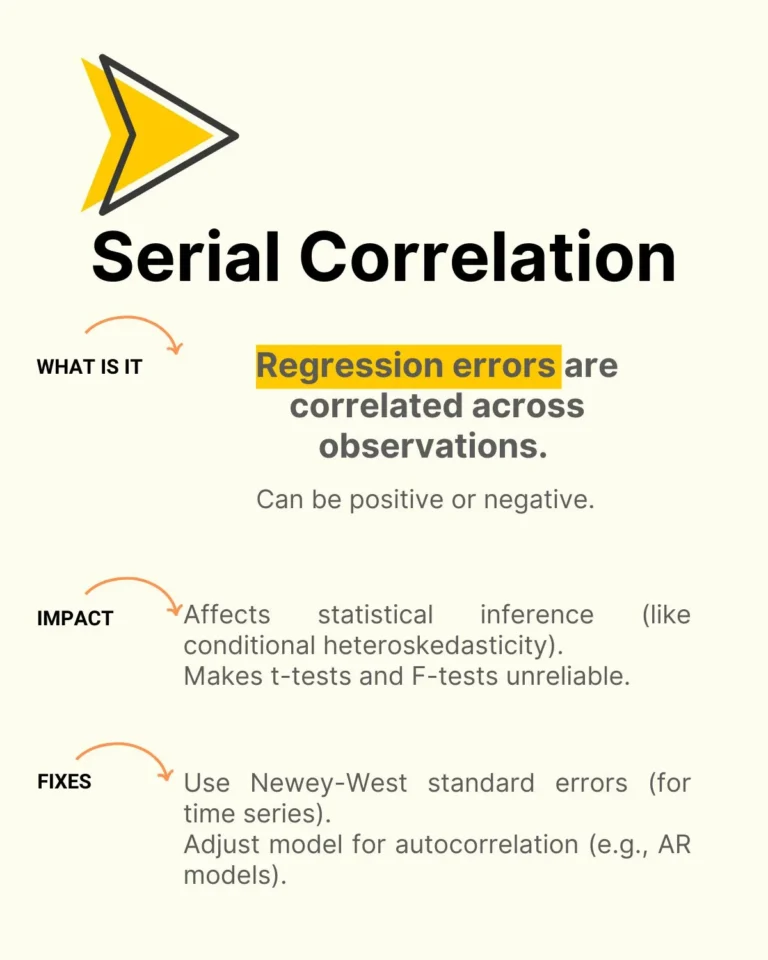

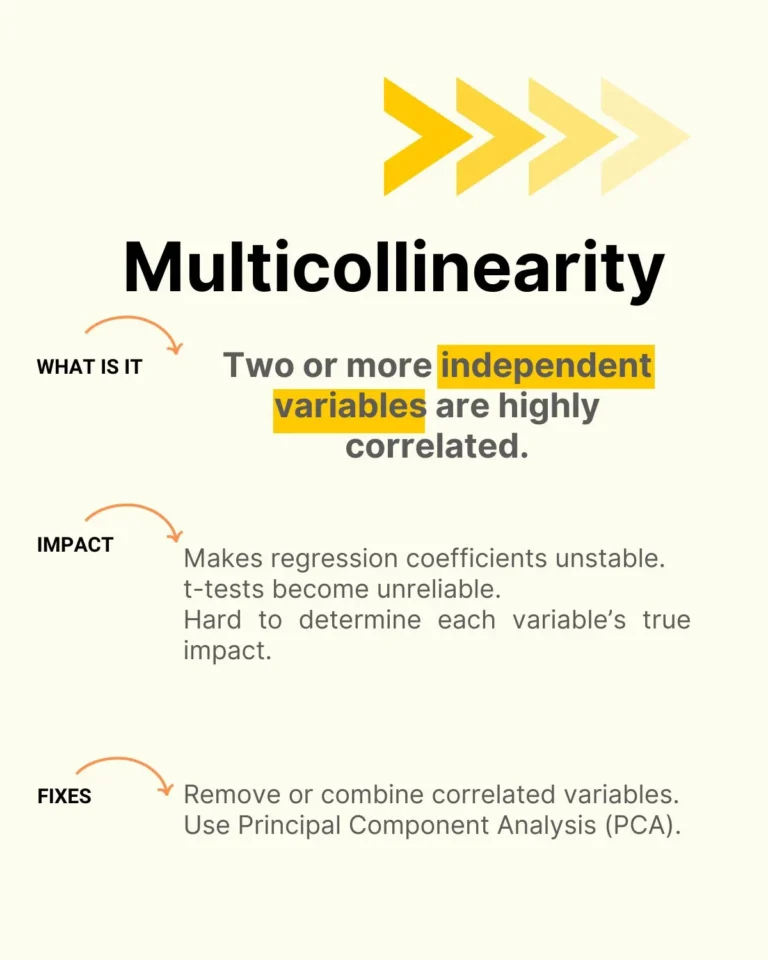

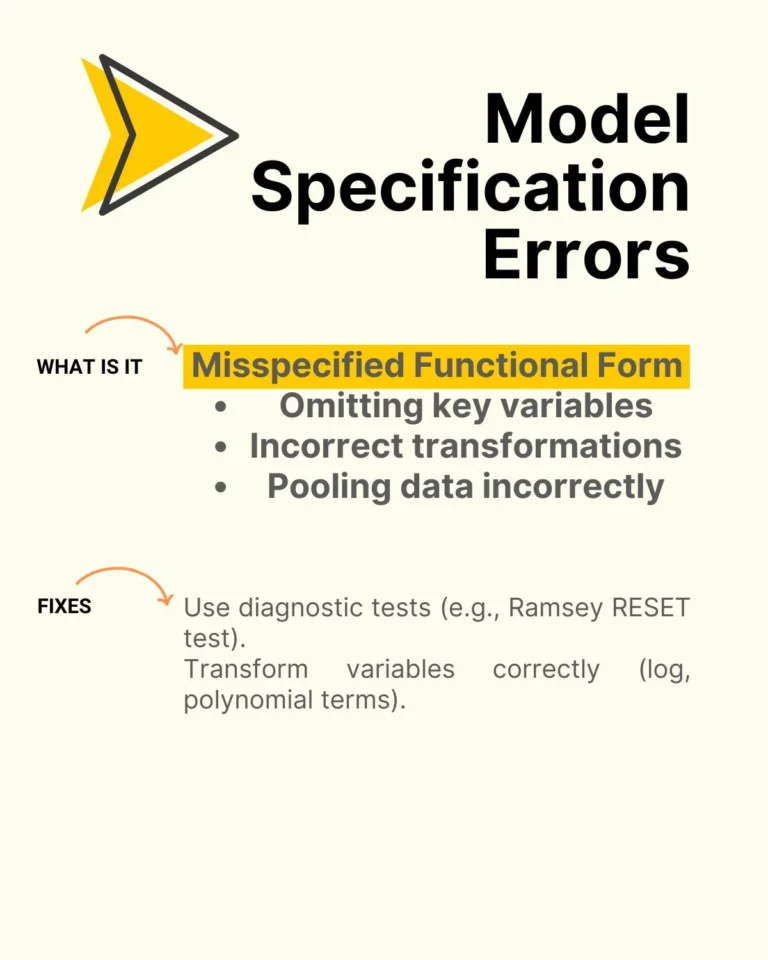

Regression Analysis – Unveiling Relationships Between Variables

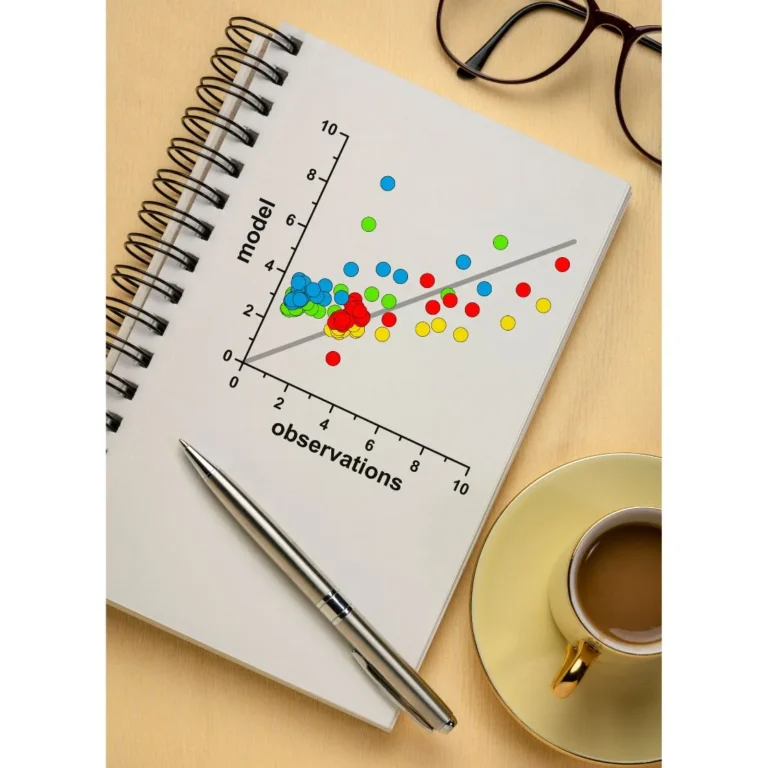

Regression analysis is a statistical technique used to identify relationships between variables.

In the context of CFA Level 2, you’ll explore linear regression, multiple regression, and logistic regression.

These models are used to analyze the impact of independent variables (such as economic indicators) on a dependent variable (such as stock prices).

Mastering regression analysis enables you to build models that can predict the behavior of financial assets based on various factors.

This skill is particularly valuable in equity research, where analysts use regression models to forecast earnings and stock prices.

Real-World Application: Equity Valuation

In equity valuation, regression analysis is often used to identify the factors that drive a company’s stock price.

By analyzing the relationship between a company’s earnings, interest rates, and other variables, you can develop a more accurate valuation model.

This ability to quantify the impact of different factors on stock prices is a key skill for any financial analyst.

Monte Carlo Simulation – Navigating Uncertainty with Confidence

Monte Carlo simulation is a technique used to model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables.

In CFA Level 2, you’ll learn how to use Monte Carlo simulations to assess the risk and uncertainty in financial models.

This technique is particularly useful in complex scenarios where multiple variables interact, and it allows you to visualize a range of possible outcomes rather than relying on a single point estimate.

Monte Carlo simulations are widely used in portfolio management, risk assessment, and derivative pricing.

Modern Example: Risk Management in Derivatives

Monte Carlo simulations are extensively used in the pricing of derivatives, where the outcome is influenced by multiple uncertain factors, such as interest rates, stock prices, and volatility.

By simulating thousands of possible scenarios, you can gain a deeper understanding of the risks associated with a particular derivative, allowing for more informed decision-making.

Doozy Digest

A newsletter for CFA candidates

Subscribe for:

✔ Insightful tips

✔ Expert advice

✔ Career motivation

✔ Exam inspiration

Stay updated and subscribe today!

The Strategic Approach: How to Master Quantitative Methods

Develop a Study Schedule: Consistency is Key

Success in Quantitative Methods requires a disciplined and consistent approach to study.

Given the complexity and breadth of the material, it’s essential to allocate regular time slots in your schedule dedicated solely to this topic.

Breaking down your study sessions into manageable chunks (such as reviewing statistical concepts one day and practicing time series analysis the next) will help you maintain focus and build a solid foundation.

Practice, Practice, Practice

Theoretical knowledge is only the first step.

To truly master Quantitative Methods, you must apply what you’ve learned through practice.

This means working through as many practice questions and case studies as possible.

The CFA Institute provides a wealth of practice problems that mimic the format and difficulty of the exam questions, making them an invaluable resource.

Use Real-World Data: Bridging the Gap Between Theory and Practice

One of the most effective ways to internalize Quantitative Methods is to apply them to real-world data.

This not only helps reinforce your understanding but also makes the material more relevant and engaging.

For example, you could analyze historical stock prices using time series analysis or build a regression model to predict the impact of economic indicators on market performance.

Leverage Technology: Tools to Enhance Your Learning

In today’s digital age, there’s a plethora of tools available to aid your study of Quantitative Methods.

Statistical software like Excel, R, or Python can be used to perform complex calculations and run simulations, allowing you to focus on understanding the concepts rather than getting bogged down in manual calculations.

Join a Study Group & Collaborate

Study groups can be incredibly beneficial, especially when tackling a challenging topic like Quantitative Methods.

Collaborating with peers allows you to share insights, clarify doubts, and gain different perspectives on difficult concepts.

Moreover, explaining concepts to others is one of the best ways to reinforce your own understanding.

Final Thoughts

Mastering Quantitative Methods for CFA Level 2 is about acquiring a set of skills that will serve you throughout your career in finance.

If you don’t have a technical mathematical / statistical educational background – some of the concepts can be challenging.

But hang in there.

Work through the material slowly and consistently.

Aim for understanding, and integrate the knowledge with a lot of practice.

The ability to analyze data, draw meaningful conclusions, and make informed decisions is invaluable in today’s complex financial environment.

As you continue your CFA journey, remember that success in Quantitative Methods comes from a combination of understanding the theory, applying it to real-world scenarios, and practicing consistently.

Embrace the challenge.

Stay disciplined.

And keep your eyes on the prize.

The mastery of Quantitative Methods is within your reach – seize it with both hands.