Understanding the Master-Feeder structure is critical for CFA candidates studying Level 1 > Alternative Investments > Hedge Funds.

This structure is a cornerstone of how many hedge funds, private equity funds, and other pooled investment vehicles organize their capital flows.

While the term may seem technical, the logic behind it is simple: a master-feeder structure allows multiple groups of investors to invest into a single central investment portfolio, achieving operational efficiency and maximizing scalability across different jurisdictions.

What Is a Master-Feeder Structure?

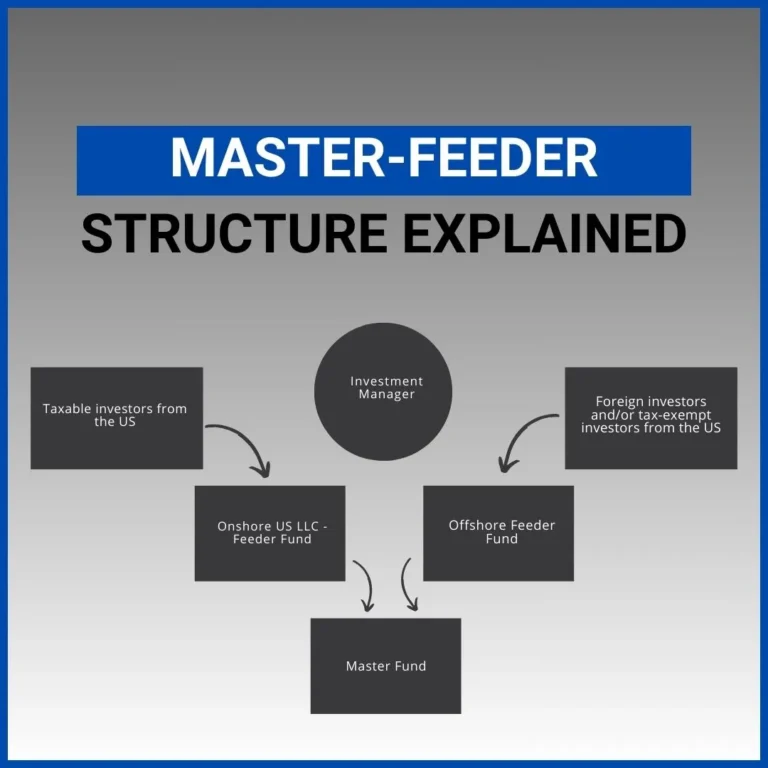

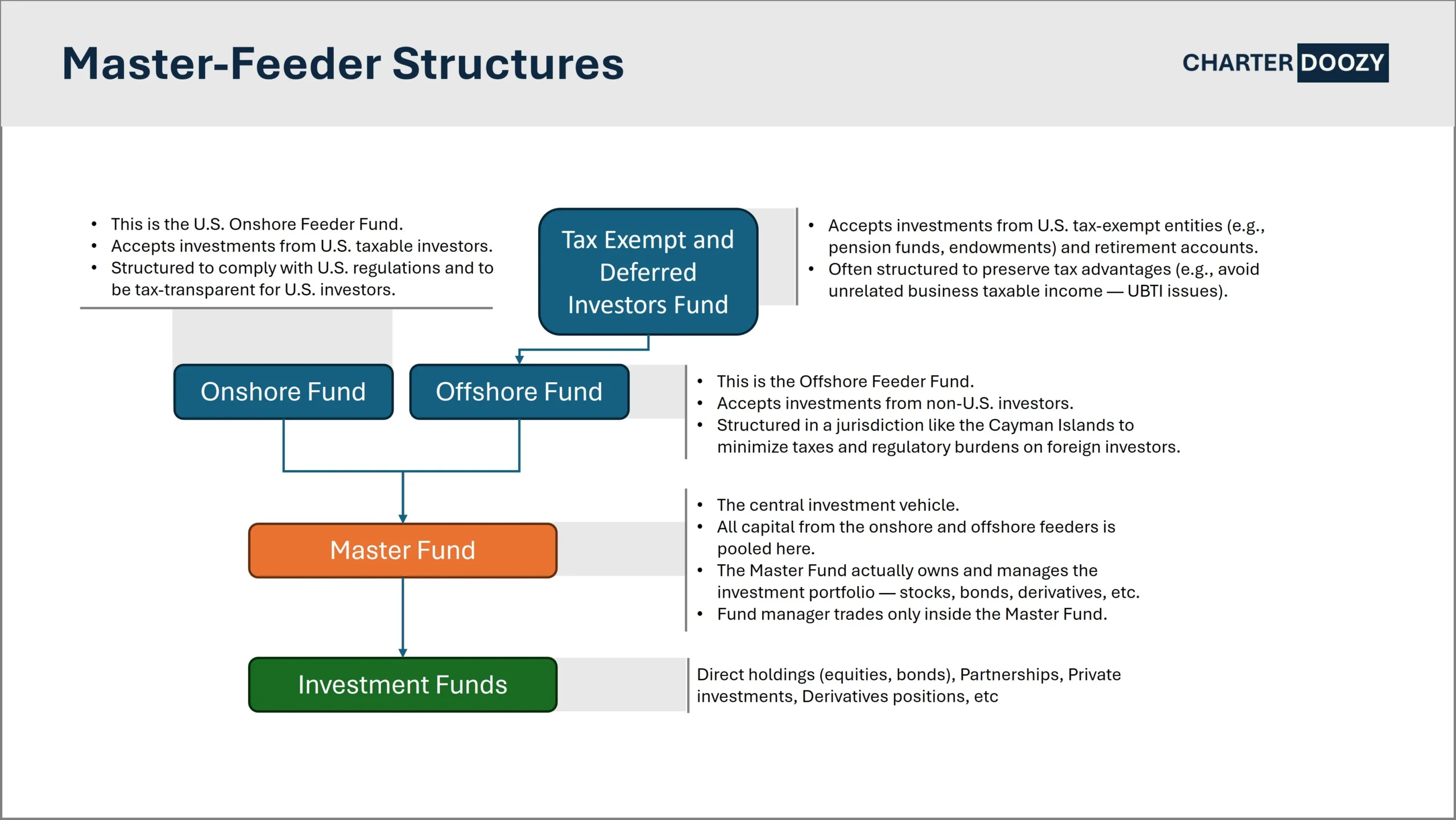

In a Master-Feeder structure, there are typically two main components: feeder funds and a master fund.

Investors place their money into feeder funds, which in turn invest all or a substantial portion of their assets into the master fund.

The master fund is the entity that executes the actual trading or investment strategy.

This structure enables the fund manager to pool assets from different types of investors into a single centralized vehicle.

As a result, the investment strategy can be implemented more efficiently and consistently across all investors, rather than managing multiple separate portfolios.

Interested in Learning About Other Hedge Fund Strategies?

Why Use a Master-Feeder Structure?

The primary reasons for using a master-feeder structure are tax optimization, operational efficiency, and the ability to accommodate different types of investors who may have varying legal, tax, or regulatory considerations.

For instance, U.S. taxable investors might invest through one feeder fund (often structured as a U.S. limited partnership), while non-U.S. investors and U.S. tax-exempt entities (like pension funds or endowments) might invest through an offshore feeder fund (commonly based in jurisdictions such as the Cayman Islands).

Both feeder funds then invest into the same master fund, allowing the fund manager to avoid having to create two separate but identical portfolios for different investor groups.

By using this structure, managers can:

Achieve economies of scale by trading through one portfolio.

Streamline administrative tasks like accounting, auditing, and reporting.

Reduce operational complexity and costs.

Customize the tax treatment for different classes of investors.

How the Master-Feeder Structure Works in Practice

At the operational level, investors subscribe for shares or interests in a feeder fund.

That feeder fund collects the capital and purchases shares or partnership interests in the master fund.

The master fund, typically structured as an offshore corporation, then invests according to the strategy, pooling all the assets received from the feeder funds.

Each feeder fund tracks the performance of its investment in the master fund and allocates gains, losses, fees, and expenses back to its investors based on their proportional ownership.

Importantly, although all investors are exposed to the same investment performance through the master fund, the tax treatment and legal relationships can differ based on the structure of the feeder they entered through.

Variations: Mini-Master and Parallel Structures

While the classic Master-Feeder structure is the most widely used, candidates should also be aware of variations such as the Mini-Master structure and Parallel Funds.

In a Mini-Master structure, U.S. taxable investors invest directly into the master fund, while offshore and tax-exempt investors invest through a single offshore feeder fund.

This approach can slightly simplify the structure and reduce administrative layers.

In a Parallel Fund structure, rather than pooling into a single master fund, different investor groups invest into separate portfolios that pursue identical strategies side by side.

This avoids some tax complications but loses the operational efficiency of pooling.

Potential Drawbacks of Master-Feeder Structures

While Master-Feeder structures offer many advantages, they are not without complexities.

Maintaining compliance with multiple tax regimes, handling different reporting obligations for each feeder, and managing the master’s internal accounting allocations all add layers of administrative burden.

Furthermore, transparency can be reduced, as investors only have direct insight into their feeder fund, not the full workings of the master portfolio.

Nonetheless, for large institutional managers seeking to raise capital globally, the trade-off is often worthwhile, and the Master-Feeder model remains a dominant structure in the alternative investment world.

CFA Level 1 Exam Tip

👉 Don’t get bogged down in tax law details — the exam focuses on the big picture.

You should know:

Why the structure is used (tax, operational, accessibility reasons)

How the money flows (Feeder ➔ Master ➔ Investments)

The benefits for fund managers and investors

Expect questions that are conceptual — not computational.

Key Takeaways

Master-Feeder structures allow fund managers to pool different types of investors into a single portfolio, maximizing operational efficiency while meeting varying tax and regulatory needs.

Although complex behind the scenes, they simplify the investment experience for end investors and enable fund managers to focus on generating returns.

For CFA candidates, understanding these structures is critical for mastering the Alternative Investments section of the curriculum.

✅ Master-Feeder structures combine multiple investor pools into a single portfolio.

✅ Tax optimization is a key driver, separating U.S. and non-U.S. capital.

✅ Operational simplicity — one portfolio instead of many.

✅ Investor flexibility — different feeders for different needs.

✅ CFA Level 1 focuses on understanding the concept, not legal technicalities.