In a world of rising tuition fees, credential inflation, and rapid AI disruption, many professionals are re-evaluating the value of traditional career investments. Among them, the Chartered Financial Analyst (CFA) designation continues to provoke a simple but essential question: is it still worth it?

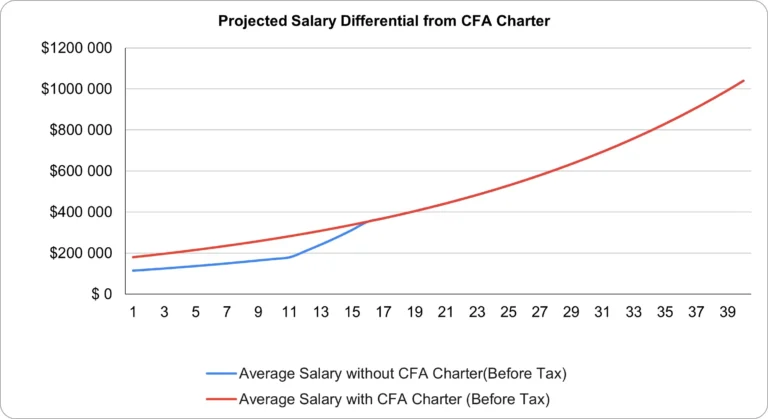

To explore this, I set out to quantify the return on investment (ROI) of the CFA Charter—not through anecdotes or marketing claims, but through a structured, economic analysis. I built a simplified financial model to estimate the present value of the additional after-tax earnings a candidate might expect to earn over the course of a typical career by obtaining the CFA designation.

I then shared this analysis with the finance community on Reddit. The response was immediate and substantial. The post was viewed by more than 87,000 CFA candidates and Charterholders, drew 78 detailed comments, and was shared 267 times. The feedback surfaced critical flaws, challenged key assumptions, and raised valuable questions that helped refine the logic and highlight overlooked variables.

This article summarizes the results of that initial model, explains the assumptions behind it, synthesizes the feedback it received, and outlines the next steps for improving the analysis.

Estimating the Value of the CFA Charter

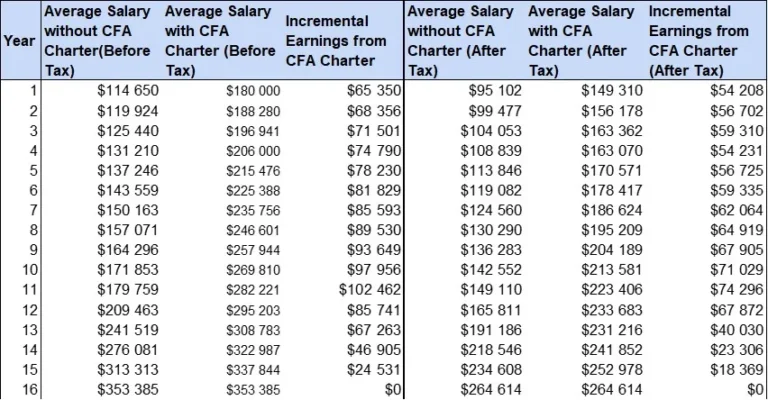

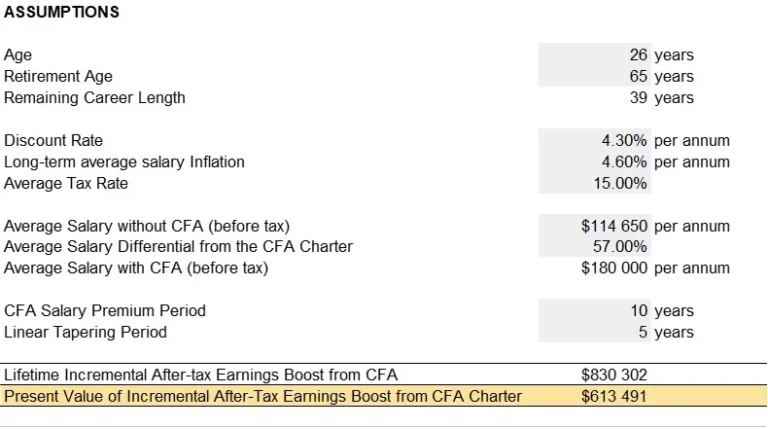

The model estimated the present value of the additional after-tax earnings a professional could expect to earn over their lifetime by obtaining the CFA Charter. Based on a range of publicly available data sources, the model produced the following results:

Total lifetime incremental after-tax earnings: $830,302

Net present value (NPV) of that amount, discounted at 4.3%: $613,491

This figure reflects the gross benefit only. It excludes the cost of the exams, the time required to study, the opportunity cost of alternate career investments, and the risk of not completing the program. These will be addressed in future iterations, but the goal of this first version was to isolate the economic benefit alone.

Key Assumptions Behind the Model

To make the calculations, I assumed a starting age of 26 and a retirement age of 65, implying a 39-year career span. I used salary data from the CFA Institute’s credential comparison and a 2023 salary study from 300Hours, which estimates that CFA Charterholders earn approximately 57% more on average than their non-Charterholder peers.

This implies a pre-tax salary of $180 000 for CFA Charterholders, compared to $114 650 for those without the designation.

I applied a 4.6% annual salary growth rate (reflecting long-term U.S. wage inflation), and assumed the 57% salary premium holds steady for the first 10 years, tapering linearly to zero over the following 5 years. The resulting future earnings were discounted using a 4.3% rate (the yield on 10-year U.S. Treasuries), and then taxed using effective average federal rates for single filers.

The end result is a six-figure NPV benefit. But is this number realistic?

What the CFA Community Had to Say

Posting the model on Reddit’s r/CFA community led to more than 13,000 views and dozens of comments—some humorous, others sharply critical, and many insightful. Several themes emerged from the feedback:

Starting Salary Is Likely Overstated

Several users noted that using the average CFA Charterholder salary of $180,000 as the starting point at age 26 is inaccurate. That figure includes senior professionals with decades of experience. In reality, a newly minted charterholder at 26 is unlikely to earn that much immediately. This point is well taken. The next version of the model will incorporate a more realistic starting salary and a slower ramp-up over time.

The Premium Likely Doesn’t Vanish

The assumption that the salary premium tapers to zero after 15 years was also challenged. Critics pointed out that while the explicit credential premium may fade, the indirect benefits likely persist. CFA Charterholders are more likely to be promoted earlier, gain access to senior roles, and build valuable networks. These compounding career effects suggest that the CFA’s value may extend further than modeled. The next iteration will model this effect more thoughtfully.

No Accounting for Cost or Completion Risk

Many noted the model omits the cost of obtaining the Charter—both in terms of exam fees and hundreds of hours of study time. More importantly, it assumes guaranteed completion. In reality, many candidates never finish all three levels. Future versions of the model will account for these factors by incorporating estimated pass rates, dropout probabilities, and monetary/time costs.

Selection Bias and Statistical Validity

Another recurring critique was the risk of selection bias. People who choose to pursue the CFA are often more ambitious and capable to begin with. Their higher earnings might reflect those traits—not the Charter itself. A more rigorous analysis would attempt to control for this self-selection by comparing matched cohorts or using regression techniques.

Taxes, Discount Rates, and Scenario Modeling

Technical suggestions also flowed in. Some suggested using marginal rather than average tax rates. Others recommended modeling a full yield curve rather than a flat discount rate. Several urged the inclusion of scenario analysis to reflect different economic environments and job market conditions.

These are all valid points. For now, I’ve opted for simplicity to avoid spurious precision. But these are exactly the types of refinements that will strengthen future versions.

Is the CFA Still a Rational Investment?

Even after adjusting for some overly optimistic assumptions, the results remain compelling. A well-structured version of the model—factoring in more realistic salary paths, costs, and probabilities—would likely still show a solid NPV for most candidates. The conclusion isn’t that the CFA Charter guarantees wealth. It’s that, on average and over time, it appears to offer a meaningful economic advantage.

That advantage is not merely the result of three letters on a resume. It reflects the cumulative effect of early promotions, increased professional credibility, deeper technical knowledge, and the disciplined mindset that comes from passing one of the most rigorous finance exams in the world.

Of course, economics aren’t everything. The intangible benefits—like intellectual growth, personal pride, credibility with clients, and professional community—are harder to quantify but equally real. For many, these are the true reasons to pursue the Charter.

Final Thoughts

The CFA Charter isn’t a golden ticket. But for those pursuing careers in asset management, equity research, corporate finance, or related fields, it remains one of the highest-ROI investments available—especially when compared to other credentials like the MBA.

Ultimately, the best investment you can make is in yourself. And for many, the CFA Charter is a powerful tool for unlocking that investment.

I’ll be refining the model over the coming weeks, incorporating feedback and expanding it into a full decision-making framework. If you’re interested in exploring the data—or if you’d like access to the Excel model—feel free to reach out.

The numbers are only part of the story. But they’re a good place to start.