When embarking on the CFA journey, one of the most critical areas of study is Ethical and Professional Standards.

These standards form the backbone of the CFA Program and are pivotal in shaping not just your exam performance but your professional career as well.

Let’s delve into what makes this topic so essential and how you can master it for your CFA Level 1 exam.

Why Ethics Matters in the CFA Program

Imagine you’re a seasoned sailor navigating through stormy seas.

The Ethical and Professional Standards are your compass, guiding you safely through turbulent waters.

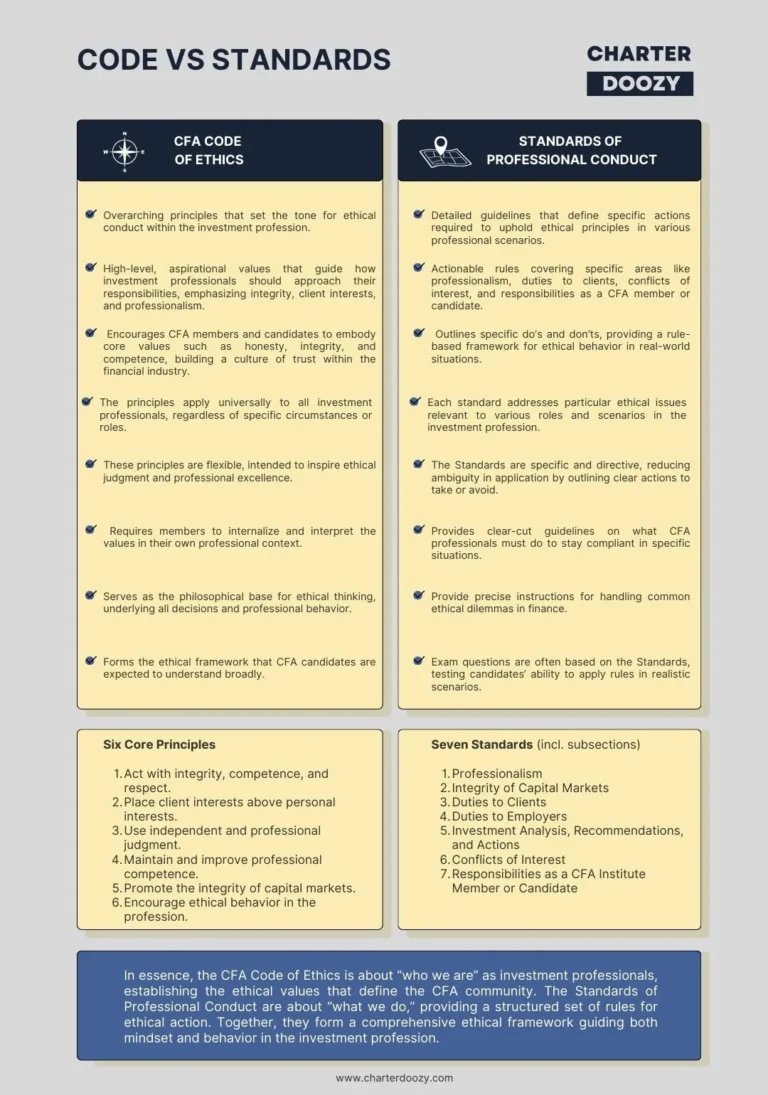

The CFA Institute’s Code of Ethics and Standards of Professional Conduct is about building trust and maintaining integrity in the financial services industry.

The Heart of Financial Integrity

At the core of these standards lies a simple truth: trust. In an industry where decisions can impact lives and economies, trust is your most valuable asset.

The CFA Institute emphasizes this by dedicating a significant portion of the CFA Level 1 curriculum to Ethical and Professional Standards.

This emphasis is not merely academic; it’s a reflection of the high ethical expectations placed on CFA Charterholders.

The Foundation of Professional Behavior

The Ethical and Professional Standards form a foundation for professional behavior, ensuring that CFA Charterholders adhere to the highest standards of integrity, transparency, and fairness.

Whether you’re advising clients, managing investments, or conducting research, these standards guide your decisions and actions, helping you maintain professional and ethical integrity.

Mastering the CFA Institute Code of Ethics and Standards of Professional Conduct

To succeed in the CFA Level 1 exam, a deep understanding of the CFA Institute Code of Ethics and Standards of Professional Conduct is non-negotiable.

Here’s how you can approach this vast topic:

Break Down the Standards

The CFA Institute Code of Ethics and Standards of Professional Conduct consists of several key components:

- Professionalism

- Knowledge of the Law, Independence, and Objectivity, Misrepresentation, and Misconduct.

- Integrity of Capital Markets

- Material Nonpublic Information and Market Manipulation.

- Duties to Clients

- Loyalty, Prudence, and Care, Fair Dealing, Suitability, Performance Presentation, and Preservation of Confidentiality.

- Duties to Employers

- Loyalty, Additional Compensation Arrangements, and Responsibilities of Supervisors.

- Investment Analysis, Recommendations, and Actions

- Diligence and Reasonable Basis, Communication with Clients and Prospective Clients, and Record Retention.

- Conflicts of Interest

- Subtopics: Disclosure of Conflicts, Priority of Transactions, and Referral Fees.

- Responsibilities as a CFA Institute Member or CFA Candidate

- Conduct as Members and Candidates in the CFA Program and Reference to CFA Institute, the CFA Designation, and the CFA Program.

Practical Application: Beyond Memorization

While it’s important to memorize these standards, it’s even more crucial to understand how they apply in real-world scenarios.

The CFA exam is notorious for testing not just your knowledge but your ability to apply that knowledge in practice.

For example, consider a situation where you’re managing a client’s investment portfolio, and you receive insider information that could significantly impact a stock’s price.

How would you act?

The Ethical and Professional Standards provide clear guidance: avoid using or sharing material nonpublic information.

Understanding the reasoning behind this, rather than simply memorizing the rule, will help you apply it correctly in the exam – and in your career.

Doozy Digest

A newsletter for CFA candidates

Subscribe for:

✔ Insightful tips

✔ Expert advice

✔ Career motivation

✔ Exam inspiration

Stay updated and subscribe today!

Historical Anecdote: A Lesson from the Past

History is rife with examples of financial professionals who disregarded ethical standards, leading to disastrous consequences.

Consider the case of Enron, where unethical behavior and a lack of integrity led to one of the largest corporate collapses in history.

The scandal underscored the importance of ethical behavior in financial services, reinforcing why the CFA Institute places such a heavy emphasis on Ethics.

The Role of Ethical Standards in the Candidate Body of Knowledge (CBOK)

In some sense Ethics is just another topic in the CFA curriculum – like derivatives, equities or portfolio management.

But in another, Ethics is woven into the fabric of the entire Candidate Body of Knowledge (CBOK).

This integration underscores its importance, highlighting that ethical decision-making should be at the heart of all financial analysis and investment management activities.

Ethics in Investment Management

When managing investments, ethical standards ensure that you’re acting in the best interests of your clients.

This includes being transparent about fees, avoiding conflicts of interest, and ensuring that your investment recommendations are based on thorough research and analysis.

Ethics in Financial Reporting

Ethical standards also play a crucial role in financial reporting.

As a CFA candidate, you’ll learn how to present financial data accurately and transparently, avoiding the pitfalls of misrepresentation and fraud.

This not only protects your clients but also upholds the integrity of the financial markets.

How to Study Ethical and Professional Standards for CFA Level 1

Studying Ethics requires a strategic approach.

Here’s how to make the most of your study sessions:

Start Early and Review Often

Ethical and Professional Standards is one area of the CFA curriculum where early and consistent study pays off.

Begin your studies with Ethics, and revisit it regularly throughout your preparation.

The more familiar you are with the material, the easier it will be to apply it during the exam.

Practice with Real-World Scenarios

The CFA Institute provides a wealth of practice questions that mimic real-world scenarios.

Use these to test your understanding and application of Ethical and Professional Standards. Pay particular attention to the nuanced differences between seemingly similar situations.

This is where many candidates slip up.

Engage with Study Groups

Study groups can be particularly beneficial when studying Ethics.

Discussing ethical dilemmas with peers can provide new perspectives and deepen your understanding.

Plus, explaining concepts to others is one of the best ways to reinforce your own knowledge.

Reflect on Personal Values

Ethics is more than following rules.

In essence, it’s about aligning with principles that guide your behavior.

Take time to reflect on your own values and how they align with the CFA Institute’s Ethical and Professional Standards.

This introspection can make your study of Ethics more meaningful and memorable.

Common Ethical Pitfalls in the CFA Level 1 Exam

Even the most prepared candidates can fall into common ethical pitfalls during the CFA Level 1 exam.

Here are some to watch out for:

Overconfidence in Memorization

Memorizing the standards is important.

But don’t rely solely on rote learning.

The exam will test your ability to apply ethical principles in complex situations.

Ensure you understand the rationale behind the rules.

Misinterpreting Questions

Ethical questions on the CFA exam are often nuanced.

Be careful not to rush through them.

Take your time to read each question thoroughly and consider all possible interpretations before answering.

Ignoring the Big Picture

It’s easy to get lost in the details of individual ethical standards.

However, it’s essential to keep the big picture in mind: maintaining integrity and trust in the financial industry.

Always consider how your actions, as depicted in exam questions, align with these overarching goals.

Book Launch: November 2025

Ethics Edge

Master CFA Ethics with Confidence

Ethics Edge breaks down Ethics & Professional Standards with clear strategies, real-world insights, and exam-tested techniques. Master the Ethics Adjustment, boost your score, and gain a strategic edge.

☑️ Master the Ethics Adjustment – Learn how to turn CFA Ethics into a strategic advantage and avoid failing on a borderline score.

☑️ Proven Study & Exam Techniques – Battle-tested strategies to decode tricky Ethics questions and maximize your score.

☑️ Personal Ethics Notebook – A guided system to track key principles, case studies, and exam insights for quick reference.

☑️ Tales from the Trenches – Learn from real-world high-profile ethical failures like Enron and Bernie Madoff, to bring the topic to life.