If you’re already on the CFA journey (or thinking of getting started) you’ll know passing the exams can prove challenging (understatement!)

One of the reasons for the consistently low pass rates, is that the program requires systematic growth of knowledge and skills from one exam to the next.

When designing the CFA curriculum, the CFA Institute didn’t just take the Candidate Body of Knowledge (CBOK) and divide it into 3 parts.

Instead, they built a 3-part journey that could grow a capable finance professional into a strategic investment expert.

Each CFA level isn’t just progressively harder – it’s intentionally designed to build upon your existing knowledge, pushing you from basic understanding to sophisticated application.

But how exactly do the CFA Levels differ from each other, and what specific skills do they emphasize?

In this article, we’ll break down the three CFA exams clearly and succinctly.

You’ll learn exactly how each level differs, the key areas they focus on, and how their respective formats reinforce specific skills.

Most importantly, we’ll equip you with practical tips and insights to help you prepare effectively, avoid common pitfalls, and ensure you’re confidently stepping toward CFA mastery.

CFA Level I – Building Your Investment Vocabulary

At CFA Level I, your primary task is mastering the foundational language of finance and investment.

This means deeply understanding and clearly describing core concepts, definitions, and basic formulas that are essential across the investment industry.

Level I covers a broad spectrum of topics including Ethical and Professional Standards, Quantitative Methods, Economics, Financial Reporting and Analysis, Corporate Finance, Equity Investments, Fixed Income, Derivatives, Alternative Investments, and Portfolio Management.

Your goal at this stage is to grasp fundamental principles and become fluent in financial terminology.

The exam format (multiple-choice questions) is specifically designed to test your foundational knowledge.

Success at this level is about precision, clarity, and a solid understanding of basic financial concepts.

Establishing a strong base at Level I is crucial as it sets the stage for the deeper analytical demands of subsequent levels.

CFA Level II – Enhancing Analytical Skills

At CFA Level II, your journey intensifies as you shift towards deeper analysis and evaluation.

You’ll encounter complex vignettes with accompanying multiple-choice questions, designed to test your analytical skills and your ability to critically evaluate detailed scenarios.

Level II emphasizes advanced financial analysis, including more sophisticated valuation methods, deeper ethical considerations, and intricate economic analysis.

Success at this stage requires rigorous analysis and thoughtful evaluation of complex financial scenarios.

CFA Level III – Strategic Thinking and Real-World Application

At CFA Level III, the focus turns to strategic integration and practical application of your accumulated knowledge.

The exam format includes both constructed-response (essay) and item-set questions, pushing you to synthesize and apply financial concepts within real-world portfolio management contexts.

Level III introduces candidates to strategic asset allocation, portfolio management techniques, advanced ethics application, and behavioral finance considerations.

Mastery at this level reflects a candidate’s readiness to effectively handle complex and practical investment challenges, demonstrating comprehensive expertise.

Comparative Analysis of CFA Exam Levels

While candidates often consider each exam in isolation, appreciating their collective progression provides invaluable insight for effective preparation.

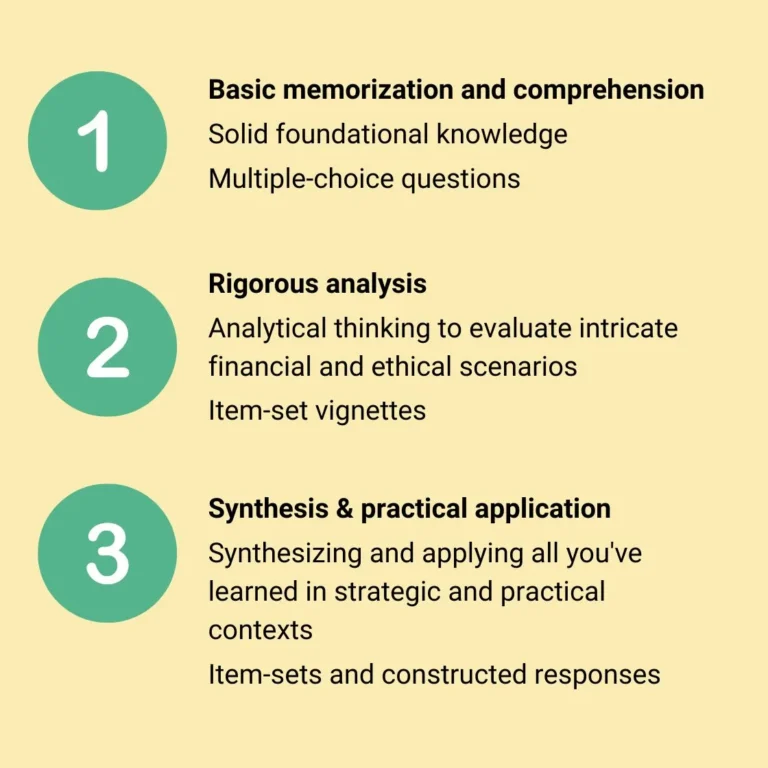

Incremental Complexity and Skill Progression

The CFA Institute deliberately structures the curriculum so each level serves as a stepping stone to the next, incrementally raising the complexity of topics and cognitive demands.

Level I sets the stage, focusing on broad foundational knowledge.

It aims to build your investment vocabulary, requiring mastery of core financial concepts, definitions, formulas, and ethics.

The primary cognitive demand at Level I is on memorization and comprehension.

At this stage, candidates learn and describe, building the essential knowledge framework needed to progress effectively.

Moving into Level II, there’s a marked shift from foundational recall to deeper analytical evaluation.

Topics become significantly more detailed and nuanced, requiring critical thinking, analysis, and evaluation skills.

The Level II exam presents candidates with item-set vignettes that mimic real-world scenarios, challenging them to interpret financial data, apply valuation techniques, and analyze ethical scenarios deeply.

Here, memorization alone is insufficient – candidates must demonstrate analytical rigor and nuanced understanding.

Finally, Level III represents the culmination of this progressive learning process, emphasizing the integration of knowledge across diverse topics and its application in realistic portfolio management contexts.

Candidates face both item sets and constructed-response (essay-style) questions that compel them to synthesize broad areas of knowledge and strategically apply concepts to complex, multi-layered scenarios.

At Level III, the exam demands synthesis, judgment, and practical decision-making (skills crucial for navigating the nuanced and challenging situations CFA Charterholders encounter daily).

Doozy Digest

A newsletter for CFA candidates

Subscribe for:

✔ Insightful tips

✔ Expert advice

✔ Career motivation

✔ Exam inspiration

Stay updated and subscribe today!

Shifting Cognitive Demands: From Memorization to Mastery

Recognizing how cognitive demands evolve through each CFA level is critical for aligning your study strategies effectively.

Level I – Memorization & Comprehension:

At Level I, you lay the groundwork by understanding and clearly articulating foundational concepts.

Your cognitive focus is primarily on memorizing key terms, understanding basic frameworks, and identifying correct applications of fundamental financial theories.

Level II – Analysis & Evaluation:

Progressing to Level II, you shift from basic comprehension toward analytical thinking.

At this level, the expectation is to analyze complex financial scenarios and evaluate alternative solutions critically.

Success requires careful reading of detailed vignettes, identification of subtle cues, and precise application of valuation and analytical methodologies.

Level III – Synthesis & Real-World Application:

Finally, Level III demands a leap into synthesis and strategic thinking.

Here, memorization and analysis alone won’t suffice—you must combine multiple concepts across the CFA curriculum, apply judgment in uncertain contexts, and clearly communicate thoughtful and well-reasoned responses.

It’s about demonstrating mastery, professional maturity, and readiness for real-world financial challenges.

In essence, each CFA exam level represents a distinct cognitive stage, progressively building your professional capabilities and readiness.

By internalizing this structured progression, you’ll better anticipate and meet each level’s demands, preparing more strategically and confidently for the challenges ahead.

Common Pitfalls Across Each CFA Level

Each stage of the CFA Program has unique challenges, and recognizing common pitfalls early can help you avoid costly setbacks later.

Recognizing these challenges at each CFA Level allows you to better tailor your study approach, anticipate challenges, and strategically prepare to overcome them.

CFA Level I – Underestimating Foundational Concepts

At Level I, candidates often underestimate the breadth and depth of foundational concepts.

With a vast syllabus covering numerous basic financial concepts and definitions, candidates sometimes mistakenly believe that a superficial grasp of these concepts will suffice.

However, CFA Level I demands thorough comprehension (not merely memorization) of these fundamentals.

Overlooking this depth can leave significant knowledge gaps, weakening your foundation and making progression to higher levels far more challenging.

CFA Level II – Insufficient Analytical Preparation

The transition from Level I to Level II often catches candidates by surprise.

A common pitfall is the failure to shift from rote memorization to deeper analysis and critical evaluation.

The Level II exam tests candidates through complex, multi-layered vignettes requiring careful analysis and interpretation.

Those who rely on surface-level recall of concepts, rather than understanding how to critically evaluate and apply them, typically struggle.

Success at Level II depends on embracing analytical rigor and honing your ability to discern nuanced financial scenarios effectively.

CFA Level III – Failing to Integrate and Strategically Apply

Level III presents its own unique pitfalls.

The greatest challenge is not merely understanding advanced concepts individually, but integrating these concepts to make strategic decisions in real-world portfolio management contexts.

Candidates who compartmentalize knowledge into isolated topics instead of synthesizing across domains typically falter here.

Furthermore, the constructed-response (essay-style) questions pose a unique challenge—candidates must clearly articulate integrated reasoning under time pressure.

Common pitfalls include insufficient practice of constructed-response questions and inadequate ability to strategically apply theoretical knowledge to real-world situations.

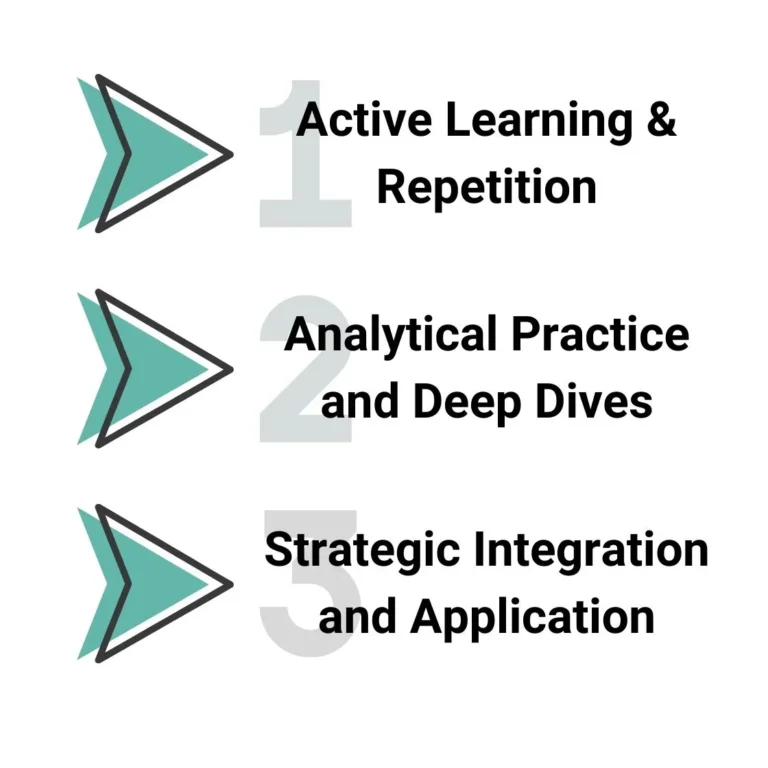

CFA Level-specific Strategies

To maximize your effectiveness in preparing for the CFA exams, it’s critical to match your study techniques to each level’s cognitive demands.

Aligning your approach with each exam level’s unique requirements ensures optimal progress and reduces frustration, streamlining your journey toward CFA mastery (and exam success).

Level I – Emphasize Active Learning and Repetition

At Level I, your primary objective is mastering foundational knowledge and terminology.

Active learning techniques—such as creating summary notes, using flashcards for key terms and formulas, and regularly revising concepts—are invaluable here.

Consistent use of targeted practice questions reinforces your memory and comprehension, helping you retain extensive foundational knowledge.

Additionally, mock exams are essential.

They familiarize you with the multiple-choice format and the discipline of applying your knowledge under timed conditions, significantly boosting your exam-day confidence.

Level II – Analytical Practice and Deep Dives

Level II preparation requires a strategic shift towards deeper analytical skills.

Focus heavily on vignette-based practice questions, as these best reflect Level II’s cognitive demands of critical evaluation and application.

Study sessions should involve thoroughly dissecting item-set scenarios, actively practicing the interpretation and evaluation of complex financial situations.

Embrace analytical exercises (such as scenario analysis, comparative financial statement reviews, and valuation case studies) to enhance your depth of understanding.

Regular exposure to mock exams simulating the vignette format sharpens your analytical proficiency and exam stamina, positioning you well for success at this challenging level.

Level III – Mastering Strategic Integration and Application

At Level III, mastering strategic integration and real-world application is your priority.

The constructed-response (essay) format presents a unique challenge: candidates must not only synthesize knowledge across topics but also communicate their reasoning clearly and effectively under time pressure.

Preparation should therefore include regular practice of constructed-response questions, allowing you to hone the clarity and conciseness of your written responses.

Mock exams replicating both item sets and essay-style questions become even more critical at this stage, reinforcing your ability to synthesize and strategically apply your accumulated knowledge.

Consider practicing scenarios drawn from real-world portfolio management contexts to align your preparation closely with the professional realities CFA Level III demands.

Final Thoughts

A clear understanding of what each CFA level demands is essential.

Your goal is to pass the exams, but along the way you’ll hopefully also evolve into a successful investment professionals.

Each CFA exam level serves a specific purpose, systematically building your financial knowledge from foundational concepts, through analytical rigor, to strategic integration and practical application.

Your job is to follow the program – one level at a time.

Trust the process!